Bruce Bennett

The current situation in the Middle East as well as recent voluntary production limitations on the part of major OPEC+ members strongly indicate that BP (NYSE:BP) could be set, not for a record year in 2024, but for a solid year in terms of earnings nonetheless. After the escalation of the Israel-Gaza conflict in October, Iran-backed Houthis have started to attack shipping in the Red Sea and tensions with Iran also put at risk one of the most important oil arteries in the world: the Strait of Hormuz. Given this backdrop, I believe oil companies in general could do well in 2024 and if OPEC+ continues to support product pricing throughout the year, BP could deliver strong results in 2024.

Previous rating

Only fairly recently, in September, did I come around and upgraded shares of BP to buy in the context of OPEC+’s voluntary supply limitations. Shares of BP have declined 12% since, mainly due to falling petroleum prices. Saudi Arabia and Russia, two of the largest oil-producing countries in the world, decided to voluntarily limit crude oil production: Saudi Arabia at the time curtailed its production by 1M barrels a day and Russia announced a 300 thousand barrel a day export reduction. Since then, however, OPEC+ members agreed to deepen production cuts and the security situation in the Middle East has greatly deteriorated which I believe will ultimately boost BP’s earnings potential. OPEC+ price actions especially are a reason for me to double down on BP as the company is set from higher average petroleum prices. BP is also one of the cheapest production companies in the large-cap energy sector, with a P/E ratio of 6.5X.

Deteriorating Middle East security setup

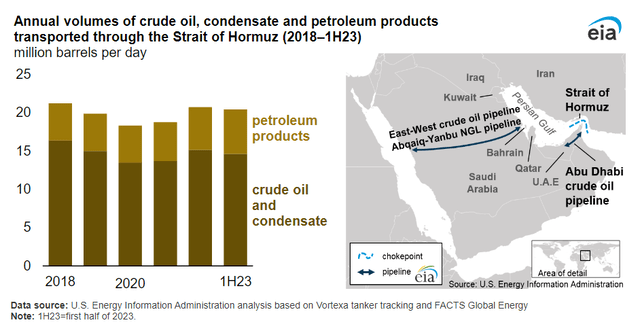

A lot has happened since I last worked on BP. Israel and Gaza are at war and Iran-backed Houthis are conducting attacks on container ships in the Bab-el-Mandeb Strait and the Red Sea. Iran is also a threat to global oil supplies by flexing its muscles in the Strait of Hormuz, the strait that connects the Persian Gulf and the Gulf of Oman. The Strait of Hormuz is one of the most important oil arteries in the world and, according to the Energy Information Administration, the equivalent of 20% of global petroleum liquids production passes through this strait.

EIA

… (the rest of the content is not shown)