imaginima

There are three things that are guaranteed in life: death, taxes, and cloud computing. And there are no ETFs that focus on death and taxes, so let’s talk about the Global X Cloud Computing ETF (CLOU), which offers investors exposure to the rapidly expanding cloud computing industry.

CLOU is an exchange-traded fund that seeks to provide investment results that correspond to the performance of the INDXX Global Cloud Computing Index. This index features companies involved in various aspects of cloud computing, including infrastructure providers, software developers, platform providers, and other related services.

The investment fund focuses on enterprises poised to capitalize on the growing utilization of cloud computing technologies and offerings. This encompasses firms engaged in providing computing services such as Software-as-a-Service (SaaS), Platform-as-a-Service (PaaS), and Infrastructure-as-a-Service (IaaS), as well as those offering managed server storage solutions and those operating as data center Real Estate Investment Trusts (REITs).

A Closer Look at the ETF’s Holdings

The ETF typically holds stocks from various segments related to cloud computing. Some of the top holdings include.

- Zscaler (ZS): As a leading cloud security company, Zscaler concentrates on providing secure connections to third-party applications, including SaaS platforms and various online resources.

- Freshworks Inc. Cl A (FRSH): Freshworks excels in delivering cutting-edge customer engagement tools suitable for businesses large and small, streamlining the process for teams to engage, win, and retain customers indefinitely.

- Qualys (QLYS): Qualys has carved out a niche in the cybersecurity landscape by offering solutions that are cloud-centric, focusing on security measures and regulatory compliance.

- Twilio (TWLO): Twilio offers a robust cloud communications framework that empowers developers to craft, expand, and manage real-time communication features within their software offerings.

- Dropbox (DBX): Dropbox stands out as a prominent collaboration platform on an international scale, revolutionizing the collaborative dynamics of individuals and teams in the workplace.

No stock makes up more than 5% of the portfolio, making this a fairly well-diversified fund within its niche.

Sector Composition and Weightings

The majority of the ETF’s holdings are in the technology sector, specifically in cloud computing and related services. The fund’s sector allocation is heavily weighted towards application software, making up over 40% of the fund’s total assets. The rest of the fund’s holdings are spread across various sectors, including internet services and infrastructure providers, data centers, and REITs.

How Does CLOU Compare to Other ETFs?

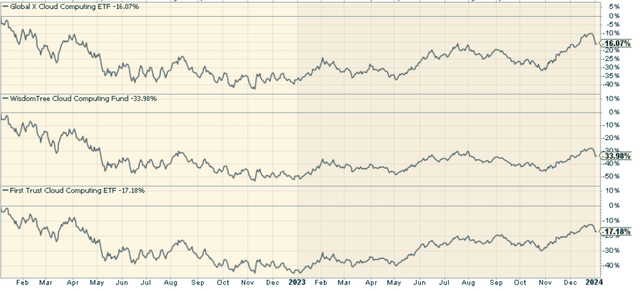

When compared to similar ETFs in the space, such as the WisdomTree Cloud Computing ETF (WCLD) and First Trust Cloud Computing ETF (SKYY), CLOU stands out for its focus on the cloud computing industry. Moreover, CLOU has shown strong performance over the past year, outperforming its peers in terms of annual return.

stockcharts.com

Pros and Cons of Investing in CLOU

Pros:

-

Diversification: The Global X Cloud Computing ETF offers investors diversified exposure to the fast-growing cloud computing sector. This reduces the risk associated with investing in individual stocks.

-

Growth Potential: As more businesses transition to cloud-based services, the demand for cloud computing is expected to increase, driving growth in this sector.

-

Accessibility: As an ETF, CLOU offers the simplicity and accessibility of a single stock with the diversification benefits of a mutual fund.

Cons:

-

Sector Concentration: The ETF’s heavy focus on the technology sector, specifically cloud computing, means it may be more susceptible to industry-specific risks.

-

Volatility: The fast-paced nature of technological innovation can lead to significant market volatility, which may impact the performance of the ETF.

-

Expense Ratio: CLOU’s expense ratio of 0.68% is on the higher end compared to other ETFs, which means that the costs might eat into the returns over time.

To Invest or Not to Invest?

The Global X Cloud Computing ETF provides a unique opportunity for investors to gain exposure to the burgeoning cloud computing industry. While CLOU captures the potential growth of the cloud industry, investors should be cautious due to inherent risks such as sector concentration, volatility, and the higher expense ratio. I like the space long-term and think it’s a good fund for what it does.

Markets aren’t as efficient as conventional wisdom would have you believe. Gaps often appear between market signals and investor reactions that help give an indication of whether we are in a “risk-on” or “risk-off” environment.

The Lead-Lag Report can give you an edge in reading the market so you can make asset allocation decisions based on award winning research. I’ll give you the signals–it’s up to you to decide whether to go on offense (i.e., add exposure to risky assets such as stocks when risk is “on”) or play defense (i.e., lean toward more conservative assets such as bonds/cash when risk is “off”).