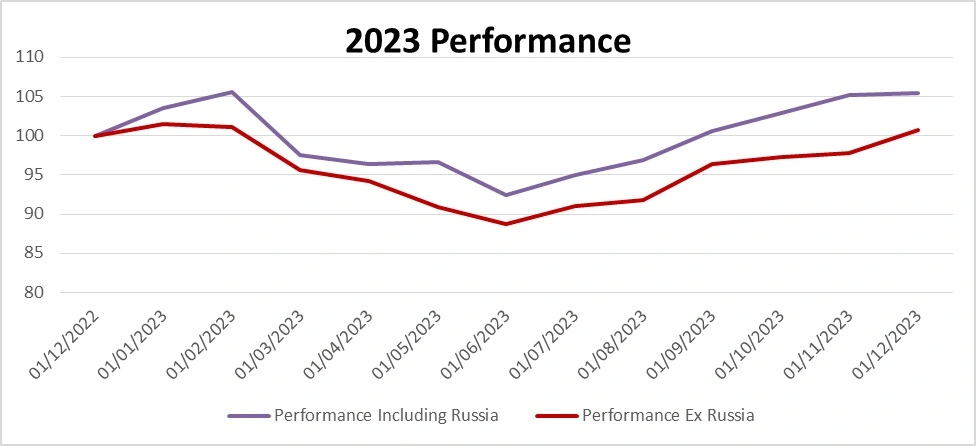

Usual end of year review here. It hasn’t gone well, overall +0.8 (excluding Russian frozen stocks) or +5.4% including Russian frozen stocks. If Russia goes back to normal will be up far more as there are a lot of dividends waiting to be collected, not included in the below.

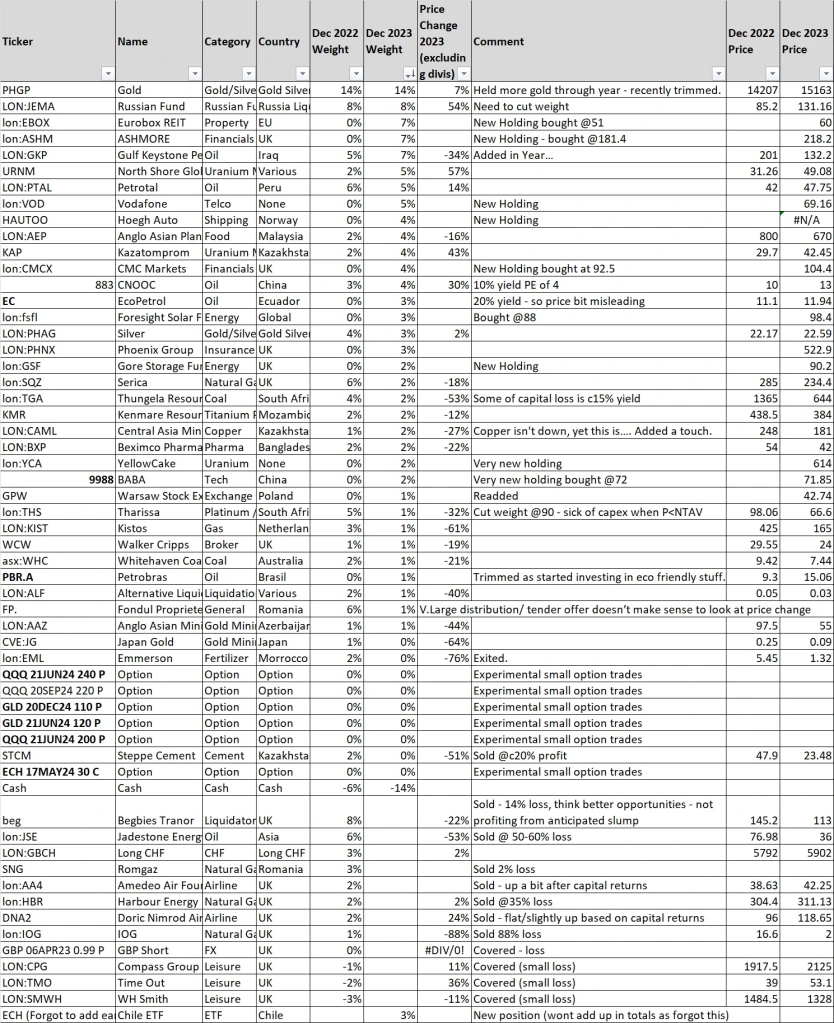

Linking back to last year I was pretty much wrong about everything. I was heavily into natural resource stocks (c57% weight vs 41% now), not the best sector in 2023. Some of the fall in weight is due to me mildly cutting weights as stocks didn’t go my way / though quite a bit is due to price falls. I had moments of good judgement – saw the possibility for political change in Russia – which very nearly came about with the Prigozhin mutiny, got into financials late in the year. Broadly things haven’t worked. There is a mild positive element to this – if I can be pretty wrong on almost everything and still not lose *much* money it’s not too bad – but it’s far from ideal given time I put in / potential returns. It’s also positive I havent gone off the rails after the large Russian loss last year – its easy to chase / raise exposure, which is something I don’t think I have done. There is an argument around stops – which I don’t use – going to be a little more careful with stocks bought at highs – particularly Hoegh Autos.

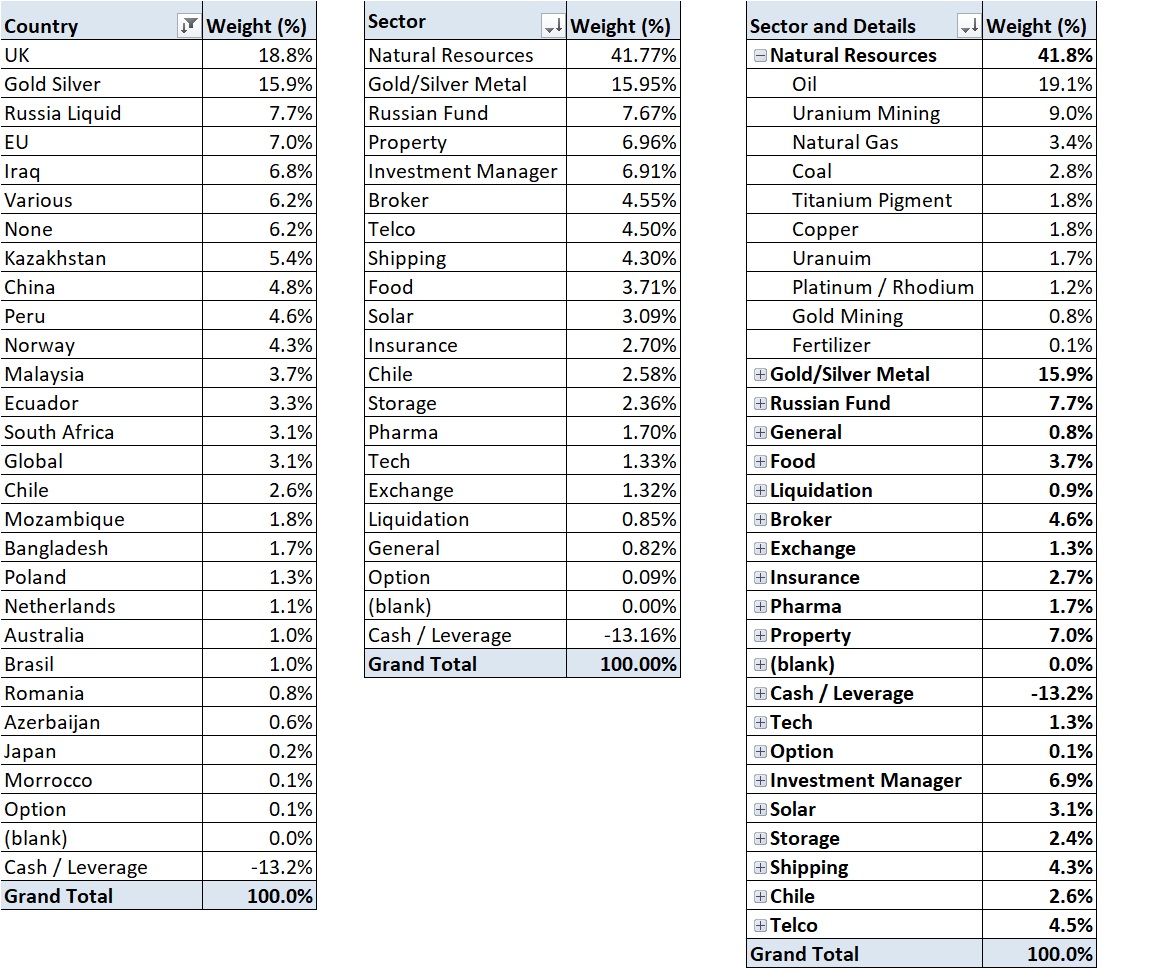

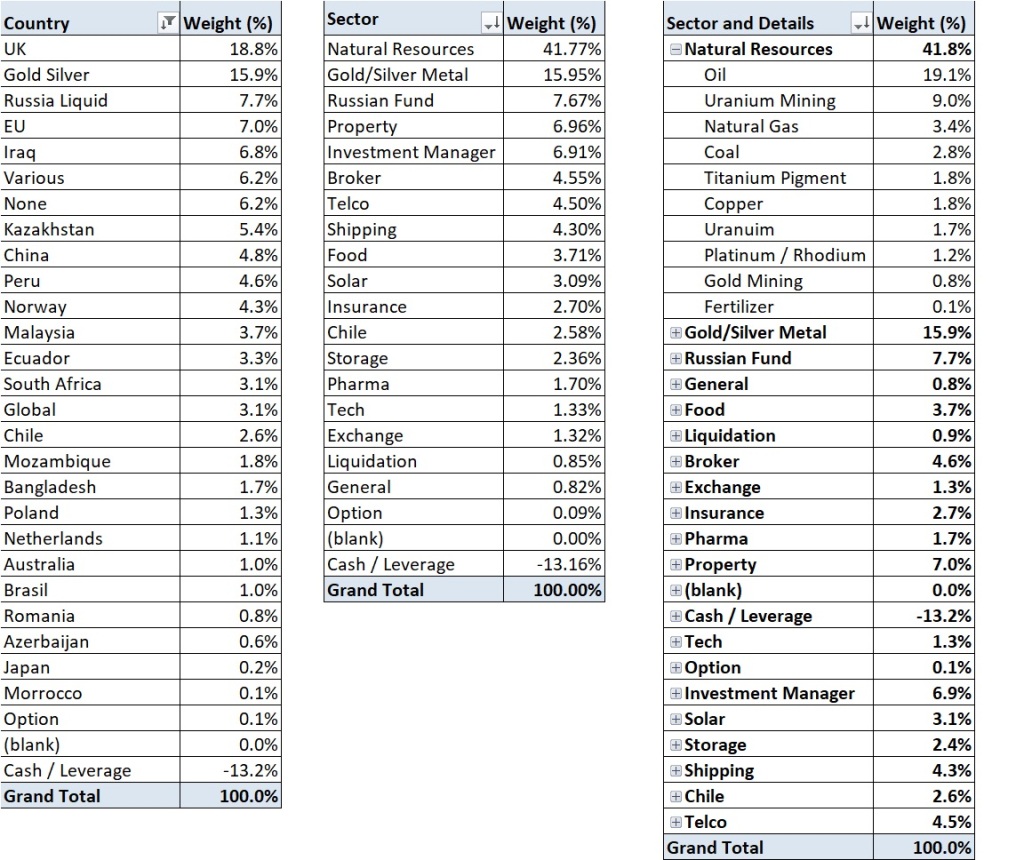

Weights are below:

…And so on.