It’s been nearly four months since I left the Corporate Beast. I thought jumping back into writing blog posts would be easy with a sudden void in my calendar. It turns out there are lots of distractions as an early retiree, and it’s not all roses.

Despite some bumps in the road, the overall picture is very good so far. Early retirement does not suck, and I am enjoying the freedom to take on different challenges and focus more on areas that need attention.

What’s not to love? I no longer have to put on a show several times a day in meetings where little is accomplished or worse, acrimony spills out among peers who are overworked and unsupported by their bosses. I now have time to focus on the rental business, which is fortunate since maintenance tasks were piling up.

Still, there is a level of anxiety that hits you (unexpectedly), even after all of the prep work and spreadsheets that convince you NOW is the time to quit. Specifically, how will we replace our health coverage? Do we have the liquidity to handle big, unforeseen expenses? And the strangest of all: Why do I feel like a failure??

Unpacking the Goodness of Quitting Corporate America

It’s no secret that corporate jobs are among the least fulfilling, yet most financially rewarding gigs you can find. I’m incredibly grateful to have spent over 25 years chopping away in that forest. Met some good friends, had a few laughs, and made serious cash along the way.

What they don’t teach you in school are the coping mechanisms for surviving the constant churn and change that define publicly traded companies. “Strategic” decisions and direction are only “strategic” in PowerPoint slides.

In truth, especially in the health care services industry, strategy is spaghetti thrown at the wall and it looks really appetizing until it starts to ooze down, is then forgotten as it slides to the floor until a new batch of leaders picks it up, rinses it off, and hurls it again at the same wall to see if it’ll stick this time. (It won’t.)

That stuff gets old fast. And I don’t miss it. Sure, there were bursts of meaningful productivity during my tenure, but the amount of wasted “productivity” probably could have paid for a half dozen kidney transplants.

Now, what passes for innovation are platitudes about Artificial Intelligence and a return to command and control management. Good leaders were shown the door, and the ones that remain are at best, simply managers.

We could also dive into the silly return-to-office policies and what joys a daily commute brings, but I’ll be happy to work from the coffee shop or my humble home office from here on in.

Taking on the Challenge of Getting a Real Estate License

This was perhaps the biggest distraction of all during my inaugural summer of freedom. A real estate salesperson license would offer all sorts of benefits to the rental business. I figured, what the hell? It can’t be that hard.

In fact, it’s borderline easy. The toughest part of getting certified as a real estate salesperson is sitting through 90 hours of on-demand material (much of it banal), and navigating the test proctoring process. As of yesterday, I knocked out the final test and checked off a nice achievement.

Why did I pursue this particular check box? I probably should have been in real estate all along, either in construction management, property management, architecture, etc. The way I drone on about it on this blog, clearly residential real estate is a passion of mine.

And that’s the beauty of early retirement with financial independence. You can switch gears and try something different without the fear of hitting skid row.

The key is to become even more useful and effective, absent the nasty side effects of “working for the man”. Part-time buying and selling houses while working towards a broker’s license will keep me engaged and generate extra income for giving.

(See, we don’t retire early to swing in hammocks and sip pina coladas all day. The world is on fire, in case you haven’t noticed. And our time and energy on this planet are more limited than we’d like to admit.)

I expect it’ll be fun to take a crack at buying and selling homes. I don’t expect a huge or steady paycheck since the competition is stiff. A local realtor recently said, “You can throw a rock and hit a realtor”. Okay – in truth, every realtor has said that…

Regardless of how many home sales I may or may not get to earn a commission from, the long view is to become a broker and build a boutique property management business. You could throw two rocks before hitting a property manager, no?

The Scary Parts About Retiring Early

Health care! Ack!!

Even though the Affordable Care Act makes things immensely more, well, affordable, moving away from a company-sponsored plan is still a scary thing to do. We landed on a $1,100 monthly premium for a Bronze HSA plan covering two adults and two kids. This is roughly what I budgeted for in the diabolical planning stages.

We still had to find a few new specialists and dentists that would be covered under the new plan. It’s not even a given that one’s meds will be covered the same as before. Fortunately, we were able to navigate most of these changes, but you could fill enough hours for a full-time job coordinating all of it.

(What we really need here, privileged people, is an early retirement concierge…)

On the health topic in general, my health took a minor hit this summer thanks to the anxiety caused by this bigly life change. Anxiety and stress from big life changes, even seemingly positive ones, are NOT fake news…

I want to blame some of this anxiety on my former employer’s management for their indifference when I announced my departure. It could be they were happy to see me go, despite the handsome bonus awarded to me a few weeks earlier.

Or, they were miffed that I announced my resignation just a few weeks after the bonus was deposited into my bank account. But I don’t think either of those is true. I did after all stick around for 3 months after submitting my resignation. I think it just boils down to human behavior and survival tactics in that awful corporate arena. Managers look out for themselves.

But as someone who managed (and LED) people for a good chunk of his tenure, I would’ve done more to acknowledge 17 years of service from one of my employees. If for no other reason than to be a good person, show goodwill, and avoid another negative promoter on the heap. Hell, I would have even done an exit interview, if it was offered. Alas…

Let Go, Oh Bitter Corporate Survivor!

Fortunately, the various inflammations from anxiety have abated in recent weeks. The completion of my real estate curriculum helped, as did a resounding bill of health at my annual physical. And no colonoscopy is due this year. That’s a whole other reason to celebrate!

So no, I don’t feel like a failure as that’s totally warped thinking. The company I worked for has struggled to move past its consulting eat-or-be-eaten DNA and retain quality leadership. Sometimes even a lucrative payday isn’t enough to keep you entertained. Where I might have failed is in the game of politics.

Knowing when to bend for the bad and perform to the hilt will get you very far in a corporate career. I just hope my kids never have to step foot in those same glass walls when their job search commences.

The Airbnb Skinny Cow

Finally, the summer has been a struggle for the so-called “Airbnb Cash Cow“. Revenues are down sharply (~25%) this year after stellar years in 2021-22. It’s a consequence of oversupply and inflation jitters. A lot of new hosts are jumping in since COVID, but it’s driving down bookings and creating a housing crisis for several markets.

I’ll write more about that situation in a future post later this fall. However, it is a contributor to anxiety when a key driver of post-retirement cash flow is on the decline.

But you know what? We don’t sit around and mope about it, we get busy and get shit done! That means new listing photos, a new pricing tool (PriceLabs), and investing in improved furnishings.

How Early Retirees Spend Their Free Time

I had an opportunity to meet up with my FIRE buddy Carl of 1500 Days to Freedom here in Minneapolis last month for a few beers. His perspective is always helpful (and I think his repeated visits to this great city hint at a future move…?)

We talked about Taylor Swift concerts and real estate, but the main takeaway for me is that THIS GUY IS BUSY. I have no need to worry about finding productive uses for my time now that I’m out of the corporate maze.

With colder months ahead and all that summer drama behind me, I hope to get back to a third or fourth reboot of this blog and build some consistency in my postings. Hope springs eternal. There is never a shortage of topics, just a shortage of motivation to write. C’mon, Cubert!

Stick with me – the ride is just beginning!

You Might Also Like:

Join the Legion of Cubicle Doom!

Sign up to have new posts and special updates sent directly to your inbox.

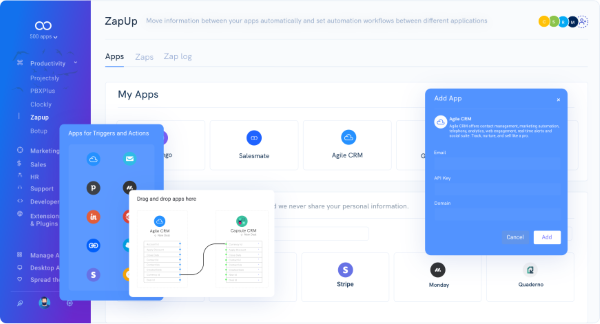

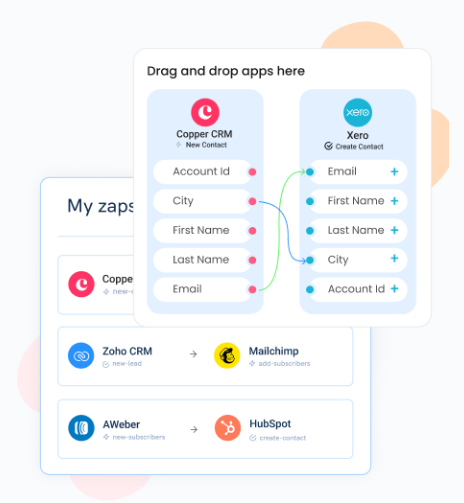

ZapUp

ZapUp

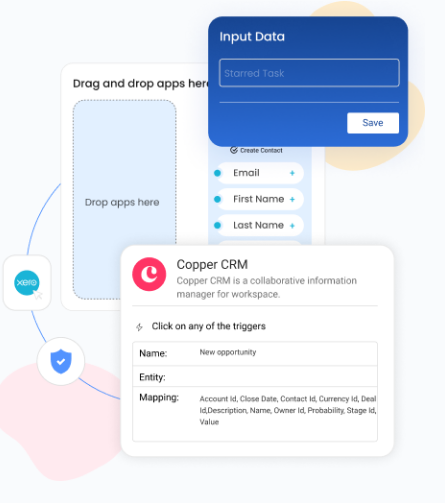

Data can be mapped to equivalent fields in other applications and exchanged in any form inside one application, making it simple to transfer, classify, and analyze afterwards.

Data can be mapped to equivalent fields in other applications and exchanged in any form inside one application, making it simple to transfer, classify, and analyze afterwards.

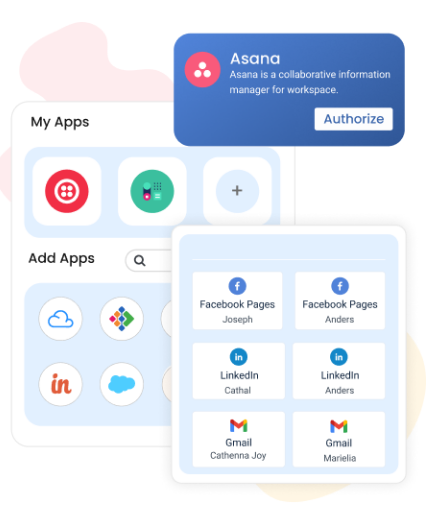

Real-time reporting can help you gain insightful information about your workflows and enhance your sales, marketing, and other key operations, which will boost efficiency and productivity.

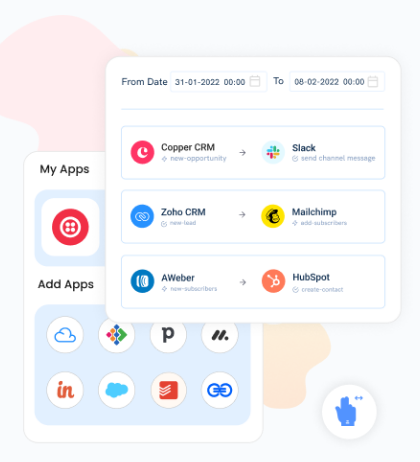

Real-time reporting can help you gain insightful information about your workflows and enhance your sales, marketing, and other key operations, which will boost efficiency and productivity. By automating and simplifying processes, business apps can save time by reducing the need for manual data monitoring and accuracy evaluation. This helps to reduce human error.

By automating and simplifying processes, business apps can save time by reducing the need for manual data monitoring and accuracy evaluation. This helps to reduce human error. Boost productivity without the help of IT by giving your company the tools to remain ahead of the competition, strengthen workflows, and save time on manual process execution.

Boost productivity without the help of IT by giving your company the tools to remain ahead of the competition, strengthen workflows, and save time on manual process execution.