Thanks for tuning in to Wealth Manifesto – where we empower you to achieve lasting financial success! #WealthBuilding #FinancialSuccess #GetRichSlowly #LongTermInvesting #FinancialFreedomTips

source

WEALTH MANIFESTATION Made Easy for Beginners

Top Holiday Custom Gift Bags

The holiday season is rapidly approaching, leaving many businesses scrambling to find the perfect gifts for their employees. The right gift can help you create a lasting positive impression. In 2023, the global corporate gifting market is worth $242 billion.

Choosing the right employee gifts is only one part of the gift-giving process. How you present these gifts is equally as important. That’s where custom gift bags come in handy.

Custom gift bags make giving a gift easy and enjoyable for happy employees. If you’re preparing for the holidays, keep reading below for more about the best custom gift bag ideas.

Custom Tote Bags

Custom tote bags are the best custom gift bags because they are a gift all on their own. These functional bags are sturdy and reusable, which is a big plus for eco-conscious employees and eco-friendly companies. They can be used to carry items like groceries and employee belongings with ease.

When giving a gift, consider incorporating tote bags as holiday gift bags for employees. A simple gift of a custom tote bag can go a long way to making employees feel appreciated. Custom items like tote bags are also kept longer by their recipients because they are useful to have around.

Branded merchandise helps instill a sense of loyalty and belonging in employees to their company. 75% of employees who receive gifts from their employer reported that receiving a holiday gift helped increase their job satisfaction. Another 46% of respondents said this feeling lasted for a year or more.

Small Gift Bag Options

When it comes to custom gift bags, there are many different sizes to choose from. Small gift bags are ideal for gifting items such as small notebooks, coffee mugs and tumblers, mini Bluetooth speakers, motivational books, and more.

Mini Non-Woven Tote

The Mini Non-Woven Tote is a great custom gift bag for employee gifts. It comes in Red, Blue, Black, and Green to match your company’s branding efforts. The tote measures 10.5″ W x 9″ H x 4.5″ D and is constructed of a sturdy 80g Non-Woven Polypropylene.

The Mini Non-Woven Tote also has a large open main compartment with a 4.5″ gusset. This tote bag is well-suited for gift items with a light to medium load capacity.

Place a screen-printed logo on this bag in an imprint area measuring 6″ W x 6″ H on the front or the back in an array of 23 different dazzling color options.

Junior Jute Tote

The Junior Jute Tote is made from laminated jute. Jute is a natural vegetable fiber. This makes it ideal for custom gift bags that are eco-friendly.

The bag features coordinating gusset, piping, and rope handle designs for eye-catching detail. The tote also has a secure Velcro enclosure. It measures 11.875″ W x 12″ H x 7.75″ D and comes in Black, Blue, Lime, Red, and Brown.

Add your 7.5″ W x 7.5″ H custom screen print on the front or back center panel in 21 different imprint color options.

Gifts for Employees

Just like with tote bags, other custom gift bags can also make terrific employee gifts. Items like toiletry bags, backpacks, and laptop bags give employees a stylish and versatile way to transport their necessities.

If you’re preparing for the holidays and looking for gift bag ideas, take a look at some of these great examples.

Saratoga 15″ Laptop Case

The Saratoga Laptop Case is the perfect way for an employee to carry their laptop in style and protection. It measures 16″ W x 11″ H x 1.18″ D and fits laptops and tablets up to 15″. It comes in a Heather Grey color and is made from 300D Two Tone Polyester, 210D Polyester, and PE Foam.

It features side zipper access to a padded laptop sleeve and has a top carry handle. It also has three outer zipper slash pockets for storing personal items. You can screen print it with your company logo or message in over 20 different colors.

Saratoga Voyage Backpack Embroidered

The Saratoga Voyage Backpack has a unique heightwise design allowing ample storage space for taller items. It features adjustable straps and a top flap buckle closure. It also contains a personal pocket for storing a cell phone or wallet.

The Saratoga Voyage Backpack measures 12″ W x 17.5″ H x 5.5″ D and is made from 1680 Ballistic Polyester. It has a spacious interior with a padded laptop pocket and a zip-closure front personal pocket.

“The Changing Face of Insurance: Exploring New Consumer Trends” – Insurance Blog

The way consumers shop for insurance has greatly changed over the past 20 years. From the rise of digital direct (and more recently, embedded) to having the option to provide data for better prices, consumers have more influence than ever before.

The core elements underpinning these changes, increasing capture and use of data and the technological capabilities to leverage and connect that data to insurance products, will continue to drive the way consumers shop for insurance, whether they choose to do so through an agent or work directly with a carrier, OEM, or other service provider. Specifically, we see a world where consumers will be able to aggregate and own their data as a personal risk “wallet”, where Generative AI will support both consumers and agents in matching risk to capital more effectively, and where niche or challenged pools of risk will be able to access insurance through new entrants who create the opportunity to match those risk pools to alternative capital.

To better illustrate those futures, and discuss the implications to insurance carriers, we will use three distinct lenses of the consumer- the mirrored consumer, curators, and the collective.

Mirrored consumer

A mirrored consumer is a rich data profile- a kind of digital twin- derived from aggregated first-, second- and third-party data that makes it possible for businesses to anticipate consumer likes and dislikes in real time. The profile can include data from sensors, wearables and haptic technologies that together create intelligent networks of digital twins and threads. It can also include data about the property that consumer owns or uses as well as their behaviors. It offers a more holistic, day-in-the-life understanding of individuals and their households.

The premise of a mirrored consumer offers several interesting futures for carriers. Specifically, carriers often focus on a finite amount of data to underwrite a risk, which is limited to what a consumer/agent tells the carrier and what the insurance carrier can accurately glean and legally use to underwrite from 2nd and 3rd party sources. We see a future in which insureds create their own risk exposure “wallet” where insureds compile the data that would typically be leveraged to underwrite as well as adjacent data that a carrier may not have previously had access to in order to create a much richer and more complete data profile. Insureds will be able to take this “wallet” with them to different carriers to get the best price and coverage, weighing the inherent trade-off of sharing more or different data relative to the value offered by the carrier for that increased access. Further, we see a future in which instant updates are provided on an insured’s exposures to carriers (with the insured’s permission) to get more accurate pricing and turn coverage on or off. For example, the sale of a car acting as a trigger to remove that car from the policy, the replacement of a roof acting as a trigger to re-rate a home, or healthy activity acting as a trigger to reduce life premiums could all be plausible scenarios of “instant updates” leveraging this consumer lens.

In market, we see a few examples of the mirrored consumer coming to life. Earlier this year, the State of California built a proof of concept that put vehicle titles on a private blockchain. Imagine being able to store the title to a vehicle that you own in your digital wallet. The addition of that title could trigger the addition of that vehicle to your current auto policy, or the transfer of that title could trigger a removal of coverage for that vehicle. The same could apply to other forms of property. As another example, last year State Farm made a $1.2B equity investment in ADT. By more closely partnering with ADT, State Farm will be better positioned to predict and prevent losses from occurring, enhancing its value proposition to its insureds that are ADT customers. By forming these partnerships, insurers will gain a better understanding of consumers’ behaviors and the extent to which they mitigate or introduce risk.

To respond to the future of a mirrored consumer, there are several actions we recommend a carrier take in the near- and medium-term:

Target market

- Tighten the definition of the target consumer and the data that you think you will need from them to underwrite their risks; increasing amounts of data allows for deeper segmentation and will tip the scales in the favor of specialists that can personalize experiences, coverages, and value-add services vs. generalists.

- Bring claims experience data forward to define the type of consumer to pursue versus legacy paradigm of using historically based models to predict future losses.

Distribution and purchase experience

- Explore ways to get closer to the interactions/life events that will trigger coverage changes or new coverage needs.

- Leverage partnerships to increase access to consumer data and insights and generate sales opportunities.

- Determine techniques to make the carrier/agency/consumer data exchange more seamless and efficient.

Product, pricing, and underwriting

- Leverage Generative AI and Large Language Models to dynamically request information from consumers and bring structure to unstructured data and inputs to further refine the ability to provide tailored products at tailored prices for consumers.

- Develop strategy for use of 1st, 2nd, and 3rd party data, including the vast/increasing amounts of unstructured data, balancing efficacy on pricing accuracy vs. cost.

- Confirm tech stack, including rating/pricing engines and policy admin systems can handle real-time requests.

Curators

Curators are much more sophisticated than today’s chat bots or recommendation engines. These digital personal shoppers are highly automated AI intermediaries that need little human interaction. Some curators will work on behalf of consumers to improve buying, while others will work on behalf of companies to improve selling.

In an insurance context, a curator has the ability to augment the role that has traditionally been played by the agent/ broker, including automating certain activities that the agent/broker performs today. From an agent/broker perspective, a curator can help the consumer find the best coverage and price, leveraging data about the consumer, their property, their behaviors (e.g. telematics), their risk appetite and preferences. Further, instead of the traditional process of shopping/remarketing at renewal, the curator can always be shopping, leveraging the most up to date data on a consumer (including new transactions/assets that might require additional coverage on new or existing polices) and market appetite to constantly search for the best match at the best price. This has the dual benefit of reducing level of effort a consumer must spend on what is largely an unenjoyable insurance shopping experience while creating time and opportunity for the agent/broker to improve productivity and deepen consumer relationships. The idea of the curator can extend beyond risk matching to negotiation– we see a future where the curator can negotiate with different carriers to get a better price for comparable coverage through highlighting different elements of a consumer’s risk wallet.

In our latest insurance Insurance Consumer Survey, 60% of respondents across all demographic groups said they would be willing to share a lot of data for faster, easier services. So, in an era where the use of curators will be increasingly more common, there are a few actions we recommend carriers take in the near- and medium-term:

Target market

- Develop an understanding of what types of consumers are most likely to value a curated experience (which may require consumers to share data but facilitates up-to-date coverage and optimal pricing relative to a traditional experience).

Distribution and purchase experience

- Design the desired consumer experience by product/coverage (e.g., what is the trigger, how is that trigger detected and how often is it acted upon, what actions are performed autonomously versus when does the consumer need to review and approve).

- Develop perspective on the role and value prop of carrier field staff when curators have greater proliferation.

Product, pricing, and underwriting

- Outline operational and technical capabilities to account for a world in which curators are constantly shopping their consumer’s risk (making sure a distribution partner’s use of curators does not create operational overload within your own organization).

- Identify the data/signals that would be leveraged to initiate coverage change.

- Investigate coverages that are more episodic/periodic to account for changing needs of a consumer.

- Brainstorm alternate ways to make consumers “sticky” through up-sell/ cross-sell (demonstrating advocacy for the consumer), value-add services, delivery of claims services/outcomes, etc. as increased frequency of shopping means that a consumer may be less brand loyal.

Collectives

Digital technologies have made the world smaller, bringing people together in ways that were impossible in the days of analog. In the context of physical products, we’ve seen an uptick in boundaryless, global virtual communities embracing their purchasing power- leading to our last consumer lens, the collective.

Historically, insurance has been built on pooled risk (or the collective) and that has benefits and downsides. As a collective, we pay for the whole pool of risk – drunk drivers, other nefarious actors/actions, etc. Over the years these risk pools have shrunk based on zip code, age, gender, and a host of other factors. As better risk wallets are developed for individual consumers, there will be a demand from buyers that the collective is even more granular and closer to the level of individual risk profiles providing more appropriate coverage to price.

Beyond more individualized pricing, we see insurance collectives being formed around the products and services that insurance is designed to protect. This is facilitated by the continued growth of digital commerce and ease of purchase and bundling. Carriers can better meet the needs of the collective by tailoring their product offerings and embedding their insurance offers into the purchasing experiences of the underlying products and services. This is already occurring in a number of insurance product lines. Multiple OEMs are partnering with insurance companies to offer auto insurance on the vehicles that they sell to consumers at the point of vehicle purchase. Several carriers are partnering with ride sharing services to offer coverage tailored to the specific needs of hybrid personal/commercial drivers. Travel insurance is being embedded in the process of purchasing an airline ticket.

Incrementally, we see one potential future of increasing proliferation of insurance companies focused on niche or challenged areas of risk (like MGUs or captives). This is a potential threat to existing insurance models, which will amplify in intensity as non-traditional entities use a combination of increasingly differentiated data & analytics skillsets, growing amounts of non-traditional risk data, and burgeoning alternative capital to compete for this business. We are already seeing the start of this in market. SageSure is a quickly emerging Managing General Underwriter with $1B in in-force premium that is specializing in coastal property risk through proprietary data and analytics and better capital to risk matching.

To prepare for the potential future that the collective consumer represents, carriers should investigate the following actions in the near- and medium-term:

Target market

- Develop a more refined view of the consumer risk profiles/risk wallets that would be within your target market.

Distribution and purchase experience

- Design the purchase experience that would get both agents and consumers more comfortable with tailoring risk solutions on a more micro scale (vs. the current state of set deductibles, limits, coverage options).

- Define distribution strategies and tactics required to market effectively to affinity groups (which will be different and more scalable than traditional agency distribution).

- Develop capabilities to continue to embed the insurance purchasing process into other commercial transactions.

Product, pricing and underwriting

- Create product pricing expertise that is effective at pricing accurately for smaller risk pools.

- Develop scalable approach to develop and price products geared to different affinity groups (and the unique data that the affinity group might provide).

- Develop scalable approach to balancing risk exposure across your portfolio as increasing coverage variations for a given consumer are provided.

What’s next

As we’ve highlighted in this blog post, insurance carriers will need to be ready for a future where their product and underwriting models are revised and rebuilt to be even more flexible to new and different sources of data, where they can easily engage with consumer and agent digital curators, where they are constantly remarketing and having to remain competitive, and where they can drive new sources of differentiation and consumer value relative to other capital providers in the market.

If you’d like to discuss in more detail, please reach out to Erik Sandquist, Heather Sullivan, or Bob Besio. Additionally, if you’d like to learn more about these consumer lenses, please look to our perspective on Shopping without Shopping.

Most ACA Open Enrollment for 2024 Ends on January 16, 2024

Affordable Care Act 2024 open enrollment ends January 16, 2024 and a record number of Americans have signed up for an ACA marketplace plan. Yes, the ACA lives on, and with the Biden administration fully supporting it, it is not only safe from meeting its demise through executive or legislative changes (until at least January of 2025), but it has been significantly improved by just about every measure. The American Rescue Plan Act of 2021 added a number of enhancements to ACA plans, including additional cost sharing savings and subsidies, and the Inflation Reduction Act extended those enhancements.

If you are not already covered by health insurance, I strongly recommend signing up for an ACA plan. I’ve provided resources and answers to a number of common questions about ACA enrollment below. Even if you are not able to sign up through open enrollment for 2023, you may still be eligible to enroll through special enrollment. Read on for more details.

What are the Open Enrollment Dates?

Open enrollment closes for most states (the ones that utilize healthcare.gov for their exchange) ends January 16, 2024, however, you may be eligible for a special enrollment period with a qualifying life event. There are a number of insurance options for newly uninsured individuals, including ACA plans, outside of the open enrollment period. Start the enrollment process to see if you are eligible. Some states that manage their own health insurance exchanges have extended deadlines beyond January 16, 2024.

Where do I Enroll?

Healthcare.gov. If you’re in one of the states (+DC) with its own marketplace, you will be redirected from there. It’s important that you ONLY sign up for a plan by starting at healthcare.gov. If you sign up through a 3rd party, you likely will not be eligible for premium subsidies and you might be signing up for a garbage plan.

If I Currently Have a Plan, Do I Need to Sign Up Again?

If you currently have a plan, it is strongly recommended that you log in to review your options for next year and either renew or switch plans. As noted earlier, there are many new qualified plans and premiums, subsidies, and cost sharing will likely differ, per plan, each year. Additionally, premium subsidies may change based off of your income and the plans you choose. You will want to update your income and household information appropriately.

Who Should Sign Up for a Marketplace Plan?

My recommendation: everyone who does not have employer sponsored insurance (either directly or through a family member, including your parents, if you are under age 26), Medicaid, CHIP, or Medicare.

Why Should I Sign Up for a Marketplace Plan?

Because your health and financial solvency is at stake. Even the healthiest among us are just one unforeseen event or imperfect gene away from medical costs that could bankrupt us. Additionally, marketplace plans provide subsidies to almost everyone who purchases a plan on the exchanges. If you buy insurance outside of the exchanges, you will not receive subsidies.

What Does the ACA Cover?

Aside from pre-existing condition coverage and coverage of a certain percentage of your total health care costs (up to 100%) once your deductible is met, and 100% once your out-of-pocket maximum is met, ACA plans all cover the following 10 essential health benefits at any time:

- Ambulatory patient services (outpatient care you get without being admitted to a hospital)

- Emergency services

- Hospitalization (like surgery and overnight stays)

- Pregnancy, maternity, and newborn care (both before and after birth)

- Mental health and substance use disorder services, including behavioral health treatment (this includes counseling and psychotherapy)

- Prescription drugs

- Rehabilitative and habilitative services and devices (services and devices to help people with injuries, disabilities, or chronic conditions gain or recover mental and physical skills)

- Laboratory services

- Preventive and wellness services and chronic disease management

- Pediatric services, including oral and vision care (but adult dental and vision coverage aren’t essential health benefits)

What do I Need to Sign up for a Plan?

The Centers for Medicare and Medicaid Services (CMS) has put out a checklist of the information needed for marketplace applications.

Where Can I Get Help Signing up for a Plan, if Needed?

If you have questions about signing up or want to talk through your options with a trained professional, call 1-800-318-2596 or visit https://localhelp.healthcare.gov/#/.

Let’s get everyone enrolled at healthcare.gov!

Related Posts:

Tolerable Imperfections and a Guide to Making Choices

I recently read Annie Duke’s book on decision making called Thinking In Bets. One of her main points is that life is like poker and not chess. In chess, the superior player will always beat the inferior player unless the better player makes a mistake. There is always the correct move to make, and the correct move in every situation in the game is potentially knowable, and so chess is about pattern recognition — memorizing as many sequences as possible and then being able to draw on this library of potential moves during the game.

The best players have the deepest database of chess moves memorized and the best ability to access them quickly. Absent the very rare unforced mistake, an amateur has essentially no chance to beat a grandmaster who in some cases has as many as 100,000 different board configurations memorized (along with the correct move for each one).

However, life isn’t like chess, it’s like poker. In poker there are lots of uncertainties, an element of chance, and a changing set of variables that impact the outcome. The best poker player in the world can lose to an amateur (and often enough does) even without making any poor decisions, which is an outcome that would never happen in chess.

In other words, a poker player can make all the correct decisions during the game and still lose through bad luck.

One of my favorite examples that Duke uses in the book to illustrate the idea of good decision but unlucky outcome was Pete Carrol. The Seahawks coach, needing a touchdown to win the Super Bowl with under a minute to go, decided to pass on 2nd & goal from the 1-yard line instead of running with Marshawn Lynch. The pass got intercepted, the Seahawks lost and the play was immediately and universally derided as “the worst play call in Super Bowl history“.

But Carrol’s play call had sound logic: an incomplete pass would have stopped the clock and given the Seahawks two chances to run with Lynch for a game winning score. Also, the odds were very much in Carrol’s favor. Of the 66 passes from the 1 yard line that season, none ended in interceptions, and over the previous full 15 seasons with a much larger sample size, just 2% of throws from the 1 yard line got picked.

So it arguably was the correct decision but an unlucky outcome.

Duke refers to our human nature of using outcomes to determine the quality of the decisions as “resulting”. She points out how we often link great decisions to great results and poor decisions to bad results.

Decision-Making Review

The book prompted me to go back and review a number of investment decisions I’ve made in recent years, and to try and reassess what went right and what went wrong using a fresh look to determine if I’ve been “resulting” at all.

I reviewed a lot of decisions recently, but I’ll highlight a simple one and use Google as an example here.

I was a shareholder of Google for a number of years but decided to sell the stock last year. After reviewing my investment journal, I can point to three main reasons for selling:

- Opportunity costs — I had a few other ideas I found more attractive at the time

- Lost confidence that management would stop the excess spending on moonshot bets

- I was seeing so many ads in Youtube that I felt like they could be overstuffing the platform and therefore alienating users (I still think this could be a risk)

I think the 1st reason was my strongest logic, and while a year is too short of a period to judge, I think what I replaced Google with has a chance of being net additive over the long run.

However, as I review the journal, my primary motivation for selling Google wasn’t opportunity costs and there were other stocks that could have been used as a funding source for the new idea(s). The main reasons for selling Google was I lost confidence that management would ultimately stem unproductive spending and I was getting increasingly concerned about the pervasive ad load on YouTube.

Expenses

Google Search is a massively profitable asset with probably 60% incremental margins that has always been used to fund growth initiatives. Some of these investments earn very high returns with tighter feedback loops and clear objectives. Building new datacenters to support the huge opportunity in front of Google Cloud or the rapidly growing engagement on YouTube has clear rationale. Hiring smart engineers to work on AI technology has a longer feedback loop but is just as important. But some of the moonshot bets seemed to me like money going down the drain with no clear path toward ever earning any real return. I felt this was diluting the value of the huge pile of cash flow. My thesis was that this would eventually change, but I began losing confidence that it would.

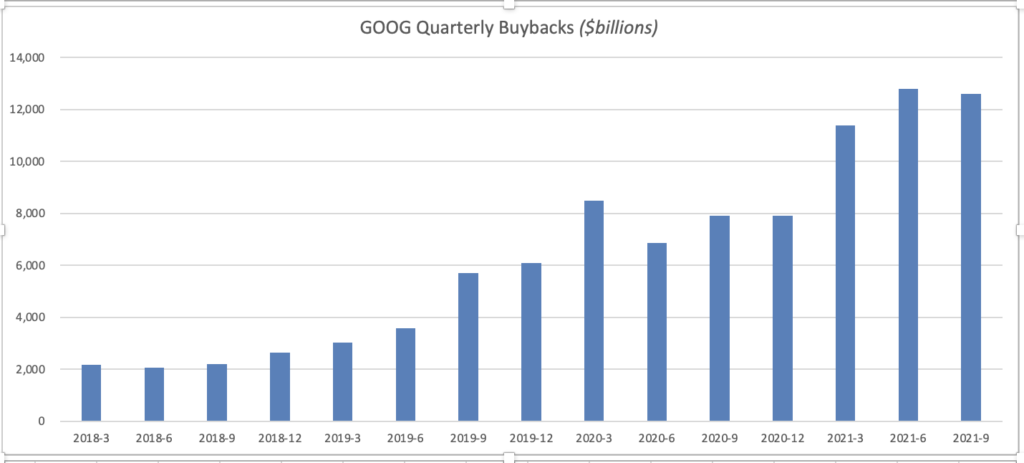

But only a year later, operating expenses have flatlined and have begun falling as a percentage of revenue, and buybacks are rising quickly and I think will prove to be a great return on investment at the current share price.

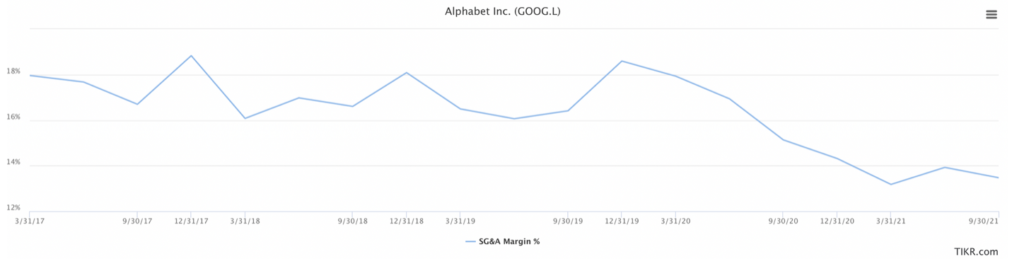

I’ve been watching operating expenses flatline, and SG&A is falling as a percentage of revenue:

Covid has been a tailwind to Google generally, but one benefit that I don’t see talked about is how shocks like Covid tend to drive more focus on core strengths. Crises tend to be tailwinds to future cost efficiencies. I read press releases on a weekly basis last year about companies selling “non-core assets” (why they’d purchase non-core assets in the first place is a question I’ve never figured out). Soul searching tends to happen during bad times and the best companies come out of a crisis in better shape, like an athlete that is more fit. Google was far from unfit prior to Covid, but it’s possible that their leadership emerged more focused. The moonshot investments haven’t stopped, but buybacks have increased dramatically during the pandemic:

This alone will be a significant tailwind to value per share going forward.

After reviewing my spending concerns, I chalk it up to a bad outcome (for me as a seller of the stock) but not necessarily a poor decision. The facts changed (management in my view has improved focus on capital allocation) and so I will change my mind.

However, I spent the most time thinking about the final reason (YouTube ad load) and here is where I think I made a bad decision. Fortunately this little post-mortem exercise led to a framework that I think will help my process.

Flaws You Can Live With vs. Catastrophe Risk

My friend Rishi Gosalia (who happens to work at Google) and I were exchanging messages Saturday morning and he made a comment that I spent the whole weekend thinking about:

“Investing is not just knowing the flaws; it’s knowing whether the flaws are significant enough that I cannot live with them.”

I thought this was an excellent heuristic to have in mind when weighing a company’s pros and cons. Alice Shroeder once talked about how Buffett would so quickly eliminate investment ideas that had what he called “catastrophe risk”. I wrote about this framework way back in 2013, and it has always been a part of my investment process. I still think it’s a critical way to evaluate businesses because many investment mistakes come from overestimating the strength of a moat. Conversely, nearly every great long term compounder is a result not necessarily from the fastest growth rate but from the most durable growth — the best stocks come from companies that can last a long time.

Thinking critically about what could kill a business has on balance been a huge help to my stock picking. But, my chat with Rishi made me realize this emphasis on cat risk also has a drawback, and I began thinking about numerous situations where I conflated known and obvious (but not existential) flaws with cat risk, and this has been costly.

I think this is one aspect of my investment process that can and will be improved going forward. Much thanks to Rishi for being the catalyst here.

Google Firing on All Cylinders

Google has in my view one of the top 3 moats in the world. The company aggregates the world’s information in the most efficient way that gets better as its scale grows, and it has the network effect to monetize that information at very high margins and with very low marginal costs. Google might be the greatest combination of technology + business success the world has ever seen. My friend Saurabh Madaan (a fellow investor and former Google data scientist) put it best: Google takes a toll on the world’s information like MasterCard takes a toll on the world’s commerce. This information over time is certain to grow and the need to organize it should remain in high demand.

Google’s revenues have exploded higher as brand advertising spending has recovered from its pandemic pause, engagement on Youtube continues to be very strong and ad budgets in some of Google’s key verticals like travel have also rebounded.

The most growth could come from the monster tailwind of cloud computing. Google will benefit from the continued shift of IT spending toward infrastructure-as-a-service (renting computing power and storage from Google instead of owning your own hardware). Google excels in data science and they have the expertise and technology that I think will become increasingly more valuable as companies use AI to improve efficiency and drive more sales.

Google could also see additional tailwinds from one of the more exciting new trends called “edge computing”, which is a more distributed form of compute that places servers much closer to end users. “The edge” has become a buzzword at every major cloud provider, but the architecture is necessary for the next wave of connected devices (Internet of Things). The multiple cameras on your Tesla, the sensors on security cameras, the chips inside medical equipment, fitness devices, machines on factory floors, kitchen appliances, smart speakers and many more will all connect to the internet and as these devices and the data they produce grows (and this growth will explode in the coming years), companies that provide the computing power and storage should benefit. Google has 146 distributed points of presence (POPs) in addition to their more traditional centralized data centers. There are a couple emerging companies that are really well counter-positioned for the next wave of the cloud, but Google should be able to take a nice cut of this growing pie.

(Note: for a great deep dive into the 3 major cloud providers, their products, and their comparative advantages along with their main competition, please read this tour de force; I highly recommend subscribing to my friend Muji’s service for a masterclass on all the major players in enterprise software, their products, and their business models).

Google is the poster child for defying base rates. It’s a $240 billion business that just grew revenues 41% last quarter and has averaged 23% sales growth over the past 5 years. Its stock price has compounded at 30% annually during that period, which is yet another testament to the idea that you don’t need an information edge nor unique under-followed ideas to find great investments in the stock market. I’ll have more to say about this topic and some implications for today’s market in the next post.

Conclusion

After this post-mortem, I still think my decision to sell the stock was a mistake. I think the change in capital allocation was hard to predict but I could have better assessed the likelihood there. I still think that the ad load on YouTube is potentially a problem, and I don’t like when companies begin extracting value at the expense of user experience. I worry about more of a “Day 2” mentality at Google. But Rishi’s heuristic has made me reconsider this issue. Perhaps this is something that can be lived with, just as I live with issues at every other company I own.

This was a general post about improving decision-making. Annie Duke points out how we crave certainty, but investing is about managing emotions, making decisions, dealing with uncertainty and risk, and being okay knowing that there will be both mistakes (bad decisions) and bad outcomes (being unlucky). It’s what makes this game (and life itself) so interesting and fun.

John Huber is the founder of Saber Capital Management, LLC. Saber is the general partner and manager of an investment fund modeled after the original Buffett partnerships. Saber’s strategy is to make very carefully selected investments in undervalued stocks of great businesses.

John can be reached at john@sabercapitalmgt.com.

The Year of the Dragon: A Year of Prosperity and Power

olaf1741/iStock via Getty Images

“The age of chivalry is past. Bores have succeeded to dragons.” – Charles Dickens

Watching with interest the mesmerizing Santa Claus rally, from TECH to US High Yield CCCs as well US Treasuries thanks to “positive correlations”, when it came to choosing our title post analogy and in the continuation of our very first post of the year 2023 relating to the Chinese Zodiac, we decided to go for “The Year of the Dragon”. It is not only the only mythical creature of all the animals in the Chinese Zodiac but, it represents unprecedented opportunities, strength, and health. 2024 marks the start of the year of the Wood Dragon on February 10. Being a movie buff, our title analogy is yet another “double entendre” given it is also a reference to 1985 movie thriller (controversial for some) by Michael Cimino starring Mickey Rourke. In this movie, the most decorated police captain Stanley White played by Rourke makes it a personal mission to crack down on Chinese organized crime. Given the continuous tensions between China and the United States, and current “low valuations” of the Chinese markets relative to the United States, we thought it would be interesting. On a side note and as a historical fact which has been largely ignored, Chinese were excluded from American citizenship up until 1943. Chinese individuals could not bring their wives to America. The Chinese Exclusion Act was the first and only major U.S. law ever implemented to prevent all members of a specific national group from immigrating to the United States. In 1943, the Exclusion Act of 1882 was finally swept away due to pressures from wartime labor shortages and popular sentiment via the Magnuson Act and only allowed 105 Chinese immigrants per year. However, in many states, Chinese Americans (mostly immigrants but sometimes U.S. citizens) were denied property-ownership rights either by law or de facto until the Magnuson Act itself was fully repealed in 1965.

In this conversation we want to look at the performance of various markets in 2023, the recent weakness seen in early 2024 and what it entails for what promises to be a volatile year in the current complicated geopolitical context with numerous elections (40) taking place in various parts of the world in 2024.

Wishing you all the very best for 2024. May the Year of the Dragon provide you with opportunities, strength, and health.

• Closing on the year of the Rabbit

Thanks to the Fed pivot narrative, the last quarter of 2023 was a boon for “high beta” in general and US High Yield in particular. CCCs lead the race and closed 2023 with a Total return performance of 17.40% CAGR, versus 9.43% CAGR for BBs (one year chart below):

Jamie Dimon Warns the Public Against Investing in Bitcoin

In an interview with CNBC, Jamie Dimon, the CEO of JPMorgan, made headlines by advising the public to steer clear of investing in Bitcoin. This statement marks the latest in a series of criticisms Dimon has levied against the cryptocurrency.

Jamie Dimon’s Stance on Bitcoin and Cryptocurrencies

Jamie Dimon has been a longstanding skeptic of Bitcoin and cryptocurrencies. His latest comments during a CNBC interview further cement his position. Dimon stated,

“I defend your right to do Bitcoin…It’s OK. I don’t want to tell you what to do. My advice is, don’t get involved.”

He emphasized his belief that cryptocurrencies like Bitcoin, which lack embedded smart contracts, hold little to no intrinsic value, likening them to “pet rocks.”

Despite his critical view of Bitcoin, Dimon acknowledged the potential in cryptocurrencies that offer practical applications, such as those involved in tokenizing real assets like real estate. He differentiated these from Bitcoin, which he perceives as having no practical use beyond trading.

Blockchain Technology and Regulatory Concerns

While critical of Bitcoin, Dimon expressed his support for blockchain technology, recognizing its efficiency and practical applications in the financial sector. JPMorgan utilizes blockchain technology, highlighting its potential beyond the sphere of cryptocurrencies.

Dimon’s criticism extends to concerns about the regulation of cryptocurrencies. He has consistently pointed out the risks associated with their illicit use and extreme price volatility. His concerns are not isolated, as regulatory bodies worldwide grapple with how to manage the growing influence of cryptocurrencies.

In a recent Senate hearing, as reported by Coingape, Dimon suggested that the government should consider banning Bitcoin, highlighting the severity of his stance. This suggestion aligns with his long-held view that the lack of regulatory oversight in the cryptocurrency market poses significant risks.

The Broader Impact of Dimon’s Views

Jamie Dimon’s opinions carry weight in the financial world, and his latest remarks are no exception. They reflect a growing debate within the financial community about the role and value of cryptocurrencies like Bitcoin. While some see them as the future of money, others, like Dimon, view them as speculative and risky investments.

His comments come when Bitcoin and other cryptocurrencies gain mainstream attention and acceptance. However, Dimon’s consistent skepticism, dating back to 2017 when he called Bitcoin a “fraud,” suggests that not everyone in the financial sector is ready to embrace these digital assets.

Read Also: Bloomberg Analyst Says Backlash for Vanguard “Highly Unlikely” To Dent the Firms Inflows

The post Jamie Dimon Advises Public to Avoid Bitcoin Investment appeared first on CoinGape.

The Ultimate Guide to Utilizing an Appointment Scheduling Tool

Whether you manage a legal firm, a medical practice, or a beauty parlor, appointments are a crucial part of managing a successful business. Maintaining a record of client schedules and making sure they are scheduled at the appropriate time can be a difficult chore. Appointment scheduling software is becoming increasingly popular among organizations because of this.

To assist you to understand how appointment scheduling tools may simplify your life and manage your business operations, we’ll address the top 10 questions regarding it in this article. We’ve got you covered on everything from comprehending the advantages of employing this tool to determining the features you require. Let’s look at how appointment scheduling software can make your life easier now.

1. What is an appointment scheduling tool?

A tool used to organize and automate the booking and scheduling of appointments, meetings, or reservations is an appointment scheduling tool. By letting clients quickly book appointments online, minimizing manual scheduling, and preventing conflicts and multiple reservations, it enables businesses and organizations to streamline their scheduling process, enhance customer experience, and increase productivity.

2. How does the appointment scheduling tool work?

Software for scheduling and managing appointments, events, or other interactions between a service provider and customers is known as appointment scheduling. Clients can often arrange appointments through the software, monitor available timeslots, and get reminders. The provider can control their schedules, examine appointment details, and interact with customers. To simplify the process, the tool frequently integrates with calendars, emails, and SMS. Additionally, it offers real-time updates and synchronization, which lowers the likelihood of double booking or other scheduling issues.

3. What features should an appointment scheduling software have?

Online appointment scheduling and booking should be possible for clients via the software’s website or connected widgets.

- Calendar management: The program must include a simple and easy-to-use calendar for assigning tasks and controlling availability.

- Automated reminders: To decrease no-shows, the program should automatically send customers email and SMS reminders.

- Payment processing: Customers should be able to pay for their appointments online thanks to the software.

Customer management: the software should store customer information and appointment history for easy reference. - Customizable appointment types: the software should allow businesses to define and offer different appointments and services.

- Multi-location support: for businesses with multiple locations, the software should allow appointment scheduling across all locations.

- Reporting and analytics: the software should provide reporting and analytics to help businesses understand appointment trends and make informed decisions.

- Mobile compatibility: the software should be accessible on mobile devices, allowing businesses and customers to manage appointments.

- Integration with other tools: the software should integrate with other devices such as email, calendars, and payment processors.

4. Can appointment scheduling software be used on any device?

It depends on the specific appointment scheduling software you are using. Some appointment scheduling software is cloud-based and can be accessed from any device with an internet connection, while others may require specific devices or operating systems. It’s best to check the system requirements of the appointment scheduling software you’re interested in to determine if it can be used on the device(s) you need.

5. How does the appointment scheduling tool integrate with my calendar?

Your calendar can be integrated with an appointment scheduling tool in a number of ways. Several prevalent techniques for integration include:

- Synchronization of calendars: The program can automatically sync your appointments with your calendar, whether it be Google, Outlook, or Apple.

- iCalendar Feed: You can add an iCalendar feed from some appointment scheduling applications to your calendar. You may use this to manage and view appointments right in your calendar.

- Plugins or add-ons: Some appointment scheduling software offers plugins or add-ons that integrate with your calendar. These allow you to view and manage appointments directly in your calendar.

6. Can appointment scheduling software handle multiple locations and staff?

Yes, most appointment scheduling tool has the capability to handle multiple locations and staff. They usually have features such as team scheduling, resource management, and location tracking, which enable businesses with multiple locations and staff to schedule appointments, manage their resources, and track their locations efficiently.

7. Can appointment scheduling software be integrated with my website?

Yes, you can connect various appointment scheduling tools with your website. You can accomplish this integration by including a widget or a booking form on your website, which will enable your visitors to make appointments right there. In order to further tailor the interaction with your website, a specific calendar scheduler additionally provides API integrations. The appointment scheduling program you use will determine the precise integration process.

8. Does appointment scheduling software have reporting and analytics capabilities?

Yes, most appointment scheduling tool has reporting and analytics capabilities. These features allow you to track and analyze key metrics such as appointment schedules, staff performance, and customer engagement, among others. The specific reporting and analytics capabilities offered by appointment scheduling tool vary, but most offer basic reports such as appointment schedules, staff utilization, and appointment history. Some more advanced software also offers real-time dashboards, custom reports, and data exports, which can provide more in-depth insights into your appointment scheduling data.

9. Can appointment scheduling software handle appointment reminders and notifications?

Yes, most appointment scheduling tools can manage reminders and notifications for appointments via email, SMS, and in-app notifications, among other channels. To make sure that clients and patients remember their forthcoming appointments and arrive on time, these reminders and notifications can be automatically generated and sent to them.

10. Can appointment scheduling software handle appointment scheduling for multiple services and service providers?

The majority of appointment scheduling programs can manage to make appointments for various services and service providers. The software typically enables the setting up of various services, their assignment to particular service providers, and online appointment scheduling for these services by clients. Numerous locations can be managed, service provider schedules can be managed, and appointment availability can be specified in certain appointment scheduling tools.

Summary

Appointment scheduling can be a time-consuming and confusing process. However, with the help of reliable scheduling software, it can become a breeze. Schedule.cc from 500apps is one such software that can make your life easier by providing a seamless appointment scheduling experience. After answering the top 10 questions about appointment scheduling software, it’s clear that Schedule.cc is one of the best options available in the market. It provides all the features you need to manage appointments effortlessly and efficiently. So, if you’re looking for a way to simplify your appointment scheduling process, Schedule.cc from 500apps is definitely worth considering.

Understanding Universal Life Insurance: Advantages, Disadvantages, and Financial Examination

In the vast landscape of insurance options, Universal Life Insurance stands out as a versatile and flexible financial tool that combines the benefits of life insurance with investment opportunities. Understanding the nuances of Universal Life Insurance is crucial for individuals seeking comprehensive coverage while exploring potential financial growth. Keep reading to learn about the pros, cons, and costs of Universal Life Insurance.

What Is Universal Life Insurance?

Universal Life Insurance (ULI) is a type of permanent life insurance that provides beneficiaries with a death benefit while accumulating cash value over time. Unlike traditional life insurance policies, ULI offers flexibility in premium payments and death benefits, allowing policyholders to adjust these aspects based on their financial circumstances.

Pros of Universal Life Insurance:

- Flexibility: One of the key advantages of Universal Life Insurance is its flexibility. Policyholders can adjust their premium payments and death benefits according to changes in their financial situation, making it a dynamic choice for those anticipating fluctuations in income.

- Cash Value Accumulation: ULI policies have a cash value component that grows over time. This cash value can be accessed or borrowed for several purposes, such as supplementing retirement income, paying for educational expenses, or covering emergencies.

- Tax Advantages: The cash value growth within a Universal Life Insurance policy is tax-deferred, meaning policyholders can accumulate wealth without immediate tax implications. Additionally, death benefits are typically paid out tax-free to beneficiaries.

- Lifetime Coverage: Universal Life Insurance covers the insured’s entire lifetime as long as premiums are paid. This makes it an attractive option for those seeking long-term financial protection.

Cons of Universal Life Insurance:

- Costly Premiums: While ULI offers flexibility, the premiums can be higher than other life insurance options. Maintaining the policy requires consistent premium payments, and missing payments can negatively impact the cash value and death benefit.

- Complexity: Understanding the intricacies of Universal Life Insurance, including how the cash value accumulates and the impact of adjusting premiums, can be challenging. Policyholders may need professional guidance to navigate the complexities effectively.

- Market-linked Risks: Some ULI policies are tied to the performance of investment markets. If the market performs poorly, the cash value growth may be affected, impacting the policy’s overall value.

Cost of Universal Life Insurance

The cost of Universal Life Insurance varies based on factors such as age, health, coverage amount, and the chosen death benefit. Premiums can be higher than term life insurance but may offer potential financial growth and flexibility that outweigh the additional cost.

Balancing Act: Weighing the Pros and Cons of Universal Life Insurance

Universal Life Insurance is a multifaceted financial tool that can provide a unique combination of life insurance coverage and investment opportunities. While offering flexibility and tax benefits, it’s important to carefully consider potential drawbacks such as complex policy structures and market-related risks. For personalized guidance on whether Universal Life Insurance is the right fit for you, consider contacting Abbate Insurance, where our experienced professionals can help you navigate the intricacies of insurance and financial planning. Contact us today to secure your future with the right coverage and financial strategy.

3 Simple Methods for Quick Cash Earning

Image Credit: Alexander Mils from Unsplash.

There comes a point in many peoples’ lives where they need to make money fast. They need to pay off a bill, get money together for an important purchase, and more. Despite how much they need it, people often think this has to be complicated.

You could find yourself in this position and not know what to do. Thankfully, you have plenty of options, and some of them can be a lot easier than you’d think. While not all of them will let you make money overnight, they can be faster than you’d think.

Three of them could be relatively easy.

Make Money Fast: 3 Easy Strategies

1. Rent Out Your Car

There are countless ways to make money outside of your day job, some of which let you get paid faster than others. One of the more notable is renting out your car, if you’re lucky enough to have one. You could end up making more money out of it than you might’ve thought.

If there are large periods of time where you don’t use your car, then you could use various platforms to rent out your car. While you could need to vet potential renters to be safe, you could end up making some relatively quick money.

2. Sell Some Jewellery

If you want to make some money straight away, then the easiest and most obvious way of doing it is to sell some of your belongings. Your jewellery could be more valuable than you’d think, especially if it’s made out of gold and similar materials. If you sell them, you could make more than you would’ve expected.

There are countless places you can sell it, many of which could offer you various rates. It’s worth spending some time researching it. Start off here: https://goldrushhouston.com/pages/cypress. You could end up selling your jewellery for a lot more than you’d think.

3. Do Some Freelancing Work

Freelancing has long been a great way to make some extra money outside of work. Many people even end up making a full-time career out of it. One of the main benefits of this is it lets you get paid relatively quickly compared to many other jobs. Some platforms even let you get paid instantaneously.

If you’re skilled in a particular area, you could consider using it to freelance with. You’ll not only help make money fast, but you could end up making a consistent income with it. It’ll end up being much more beneficial – and profitable – than you might’ve first thought.

Make Money Fast: Wrapping Up

Trying to make money fast is often complicated, and quite a few people think it’s not possible. That isn’t the case. It could be more straightforward than you’d think, and you mightn’t have to spend a lot of time on it.

With the right strategies, it could be a lot easier than you could’ve expected. You might even make more money than you’d think. It’s worth concentrating on the right areas to help with that.