Did you know that broken furnaces contribute to many property insurance claims each year? If your furnace dies or isn’t properly operating in cold weather, your home’s temperature can drop and cause frozen or burst pipes, resulting in damage. Keeping your furnace in good repair can save you money over the long term and protect your home.

Types of Furnaces in Alberta’s Homes

Most Albertans have forced-air central furnaces heating their homes. These work by heating air and blowing it through ducts throughout the home. Different fuels heat the air, including:

- Electric – Very efficient, quiet and small furnaces; they’re cheaper to install but the cost of electricity can be higher than other fuels.

- Natural Gas – The most popular fuel for furnaces in Alberta as natural gas is relatively cheap and plentiful.

- Propane – A less popular alternative to natural gas.

- Oil – Found more in rural Alberta; oil is more expensive and requires a storage tank, but oil furnaces can last longer if well maintained.

Boiler furnaces are very similar to forced-air furnaces except they circulate water through radiators rather than air through ducts.

Boiler furnaces are very similar to forced-air furnaces except they circulate water through radiators rather than air through ducts.

Maintenance Schedule for Furnaces in Alberta Homes

Regular maintenance helps ensure your furnace is running properly and can extend its lifetime. Not only will this help keep you warm during cold spells, but it will also save you money on utility bills and repairs.

Here are regular maintenance tasks you should carry out:

- Ensure all vents in your home are open and not blocked by furniture or other items. Keep these openings clean and clear (you can vacuum them if they’re dusty).

- Replace your furnace filter every 30 to 90 days.

- Pleated or polyester filters can be replaced every 90 days, unless you smoke in the house or have pets – replace it every 30 days if this is the case.

- Fiberglass filters should be changed monthly.

- If you have a permanent or re-usable filter, follow the manufacturer instructions to clean it.

- Use the correct size of filter, as the wrong size will reduce filtration and cause the filter to get dirty more quickly.

- Dirty filters can limit airflow, put strain on the blower motor and reduce filtration.

- Turn off your furnace’s power and fuel supply to clean it at least once a year.

- Use a vacuum or small brush to remove dust from the exterior of the furnace, the blower motor blades, belts and pulleys.

- Use a straw to remove dust around the pilot light and an emery cloth to clean the flame sensor.

-

Ways to Evaluate Your Business Credit Rating

Just as having a good credit score is important to your personal financial picture, having a good business credit score is critical to running a successful business.

An excellent business credit score makes it easier to obtain credit for the purpose of growing your business, financing the purchase of equipment, and managing daily operations.

In this article, we show you how to check your business credit score (paid and free options) and provide information on the business credit bureaus.

Table of Contents

- What Is A Business Credit Score?

- What Is the Difference Between a Business and a Personal Credit Report?

- How Is A Business Credit Score Calculated?

- Where to Check Your Business Credit Score

- Experian

- Dun & Bradstreet

- Nav Prime

- How to Obtain a Free Business Credit Report

- Dun & Bradstreet Credit Insights Free

- Nav

- Final Thoughts

What Is A Business Credit Score?

A business credit score is a number that indicates the creditworthiness of a business instead of an individual. Unlike personal credit scores, which can range from 300-850, a business credit score ranges from 1-100.

The score is determined using a variety of factors, including a business’s credit repayment history, public records, i.e., liens and bankruptcies, and the overall business profile.

Your business credit score gives potential lenders and others a quick snapshot of how you manage any business debt you may have.

What Is the Difference Between a Business and a Personal Credit Report?

Personal credit reports contain information about debt that you’ve taken out in your personal name. Business credit reports, on the other hand, contain information on a company’s use of credit.

In addition to repayment information, a business credit report will also contain detailed information about the business, such as:

- Date the business was established

- Information about ownership and key people

- Industry classification

- Information on any public filings

- Information about legal proceedings your business is involved in

The three main credit bureaus monitoring business credit reports are Equifax, Experian, and Dun & Bradstreet. Personal credit bureaus include Equifax, Experian, and Transunion.

How Is A Business Credit Score Calculated?

Whereas FICO personal credit scores range between 300 and 850, most business credit scores range from 1 to 100. In either case, a higher score is an indicator of stronger credit. As mentioned, business credit scores are calculated using several factors, including payment history, age of accounts, and how much debt the business has.

Where to Check Your Business Credit Score

There are a few places where you can obtain a full business credit report for a fee, including Experian, Dun & Bradstreet, and Nav Prime. Keep in mind that you’ll need to provide the following information to access your report:

- Business name

- Business mailing address

- Email address for your business

- The phone number associated with the business

- Social Security Number or EIN for the business

- Birthdate of the principal owner of the business

You may be required to provide additional information.

Experian

If you’ve looked into your personal credit report in the past, you’ve likely heard of Experian. It’s one of the three major credit bureaus you’ll need to contact about all things pertaining to personal credit, including filing a credit report dispute letter.

But Experian also has programs that help you check on and keep track of your business credit score, offering four different programs:

Credit Score Report: $39.95

This one-time report from Experian will give you a credit score (your business or other businesses), business facts, legal information, and more.

Profile Plus Report: $49.95

The Profile Plus Report includes everything in the basic credit score report, in addition to corporate information, trade payment details, inquiry details, and UCC details.

Business Credit Advantage: $189/yr.

This Experian program gives you year-round access to credit scores and reports for one business. In addition, you get all of the information contained in the one-time Profile Plus report. There are more benefits as well, including year-round alerts and monitoring.

Business Credit Score Pro: $1995/yr.

While pricey, the Business Credit Score Pro includes everything the other programs offer but allows you to access information for up to 30 businesses.

You might find this program beneficial if you deal with a lot of other businesses and need to know that they are financially sound.

Dun & Bradstreet

Dun & Bradstreet offers its D&B Credit Insights Basic program to business owners for $49.99 per month, but you’ll save $89 if you choose annual billing.

The Insights Basic report includes the following features:

- 24/7 access to all five D&B business credit scores and ratings

- Paydex Score

- Delinquency Score

- Business Failure Score

- D&B Guidance

- D&B Rating

- Historical trends of your scores and ratings

- Detailed Legal Events

- Lawsuits

- Liens

- Judgments

- UCC filings

- Basic company information

- Business operations summary

- In-app or email notification

- Integration of your business bank account

Your Dun & Bradstreet business credit report subscription automatically renews each year, but you can call to cancel or change it if you need to.

Nav Prime

Nav is a financial health platform for small businesses. In addition to helping business owners locate and track their credit scores, Nav connects businesses with loan and credit card providers.

The company’s Nav Prime program helps you to get a full view of how your company is portrayed in the credit industry.

Nav Prime costs $49.99 per month and offers benefits including:

- Detailed business credit reports and scores from around the web

- Tradeline credit reporting on your business as you make your monthly payments to Nav

- Business checking account

- Nav Prime card

The Nav Prime card is available without a credit check and without any security deposit. Think of Nav Prime as an all-in-one stop for monitoring the various business credit scores and reports.

How to Obtain a Free Business Credit Report

You can get limited information on your business credit file for free with the following programs.

Dun & Bradstreet Credit Insights Free

The D&B Credit Insights Free program is a lighter version of the Basic program mentioned above. You’ll get the following benefits with the free program:

- Scores of the following D&B ratings

- Paydex score

- Delinquency score

- Business Failure score

- D&B Guidance score

- Legal events summary

- Basic company information

- Business operation summary

Dun & Bradstreet’s Insights Basic gives you the same data but with more detail, including the D&B rating information.

Nav

Nav also has a program that allows you to check your business credit score for free when you sign up with Nav.

However, as with Dun & Bradstreet’s free program, the information you’ll get is very limited. If you want detailed business information and scores, you’ll want to sign up for the Nav Prime program outlined above.

Final Thoughts

Knowing where and how to check your business credit score is an important part of business ownership. After all, your ability to maintain excellent credit can determine if, where, when, and how you do business. An excellent credit score gives you access to higher credit limits and favorable interest rates.

If you haven’t done so already, use the resources we’ve shared above to check your business credit score today.

Stock Tracking and Merge with SIRI

Liberty SiriusXM Group (LSXMA/K) is the Malone-style tracking stock for Liberty Media’s majority ownership interest in SiriusXM (SIRI). Liberty famously bailed out SIRI following the financial crisis and made a killing on the investment (much of it early in their holding period). Nearly fifteen years later — skipping over a lot of interesting history — in December, Liberty Media reached an agreement to formally split-off their stake and merge it back with SIRI, creating a simplified one-class share structure at the satellite radio provider.

As almost all tracking stocks do, LSXM has traded at a significant discount to underlying shares it is meant to track, this transaction is meant to collapse that discount, however, even a month after the transaction was announced (and with a relatively quick, “early Q3” close) a large discount remains. The exchange ratio set forth in the merger agreement is estimated to be 8.4 (might move around ever so slightly) shares of SIRI will be issued to each share of LSXM. Using the current share prices, the spread is approximately 44.1%.

Said another way, one could effectively buy SIRI for $3.62/share via LSXM today. Why might this discrepancy exist? The primary argument I’ve seen is SIRI shares are overvalued as SiriusXM has pursued a typical Malone-style levered equity model and repurchased a significant amount of SIRI stock, which has artificially increased the price of SIRI and reduced liquidity (and increased the percentage owned by Liberty Media). That might play a small part in it (but SIRI isn’t currently in the market and presumably arbs are shorting SIRI against LSXM), but I believe the larger reason for the spread is still the hated tracking stock structure, many investors don’t understand it or simply can’t own it (won’t find LSXM in many index funds).

Looking at LSXM from a fundamental perspective, you can create SIRI for a fairly cheap valuation that should provide some downside protection post merger completion if indeed SIRI is the overvalued side of the trade.

As always, please feel free to point out where I might be incorrect. I’m using 2024 estimates from Tikr as management hasn’t provided guidance yet. It should be noted that SiriusXM is in the middle of large multi-year capex spend on revamping their satellites and free cash flow should jump considerably starting in 2025. Post-close, SIRI should become eligible for more index inclusion, including the S&P 500 where it is currently excluded as a controlled company. Similar to JXN or others, that could provide support for the shares and add a turn or two to the multiple.

There is some business risk here, SiriusXM will have considerable debt at 3.9x EBITDA and a relatively flat growth profile. SiriusXM does plan to prioritize deleveraging following the close of the transaction to get back to their 3-3.5x target leverage ratio, before fully turning back on the buyback machine. While their churn is remarkably low (surprisingly, even during Covid, subscribers didn’t cancel despite commutes dropping), their subscriber base is aging and they continue to face competition from Apple, Spotify and others. They are reinvesting in the business to push back on competition, launching a new tech stack, including a streaming only version, but I view these efforts as mostly defensive. Either way, this is a surprisingly resilient business and should be fairly stable in the near to medium term.

Disclosure: I own shares of LSXMK

Arctic Cold Causes Disruption to Iowa Campaigning During Holiday Weekend in US, Reports Reuters

© Reuters. An American flag waves after a blizzard left several inches of snow, in Des Moines, Iowa, U.S., January 13, 2024. REUTERS/Marco Bello

By Maria Caspani

NEW YORK (Reuters) – The holiday weekend brought dangerous freezing temperatures across much of the United States, snarling everything from political campaigning to football games and travel.

An Arctic blast seeping into the country from Canada caused temperatures to plummet across a vast swath of the country, from the Pacific Northwest into the Rust Belt, the U.S. National Weather Service (NWS) said in its early Sunday bulletin.

“To highlight just how intense this outbreak of Arctic air is, over 95 million citizens fall within a Wind Chill Warning, Advisory, or Watch as of midnight tonight,” the agency said.

Sunday could bring some of the coldest temperatures in states including Montana, South Dakota and North Dakota. There, meteorologists forecast wind chills as low as -70 degrees Fahrenheit (-57 Celsius.)

In Iowa, a powerful blizzard pulled the brakes on the ever-churning political campaigning machine as Republicans vying for the 2024 presidential candidacy canceled events due to the inclement weather.

Snow piled high on the side of every road in Des Moines at the center of the Iowa caucuses’ frenzy rendered political yard signs practically useless.

Reporters spotted a pickup truck full of yard signs touting Republican presidential hopeful Ron DeSantis covered in snow with nowhere to go, sitting outside the hotel where the Florida governor is staying.

David Barker, treasurer of the Republican Party of Iowa, said the brutal temperatures forecast for Monday might test even weather-resistant Iowans.

“Iowans are pretty good at handling cold and snow, so I think we’ll see good turnout, although the weather is likely to bring turnout down somewhat. It may end up being a test of how committed the candidates’ supporters are,” Barker said.

The cold weather’s grip over Iowa is not expected to loosen until well into next week, with wind chills around -40 Fahrenheit (-40 Celsius) expected across the state “at least into Tuesday,” the NWS office in Des Moines said in a post on X.

The winter storm swept across the Midwest on Saturday, cutting power to tens of thousands of households. More than 51,000 customers were without power in Michigan and more than 35,000 were without it in Wisconsin as of Sunday morning.

Extreme weather also impacted the Pacific Northwest and parts of the northeastern United States at the weekend. The city of Portland, Oregon, usually more accustomed to rain, was hit with snow, ice and strong winds that downed trees and knocked out power to over 150,000 customers. Local fire officials and media reported at least two weather-related fatalities.

Thousands of flights were canceled across the country over the Martin Luther King Jr. holiday weekend due to the extreme weather conditions.

New York Governor Kathy Hochul issued a travel ban for Erie County on Saturday and the National Football League postponed the Pittsburgh Steelers vs. Buffalo Bills game to Monday due to the expected blizzard.

Forecasters expect treacherous winter weather in the middle and southern United States on Sunday, bringing a mix of snow, sleet and freezing rain.

The post Arctic cold envelops US during holiday weekend, disrupting Iowa campaigning By Reuters first appeared on Investorempires.com.

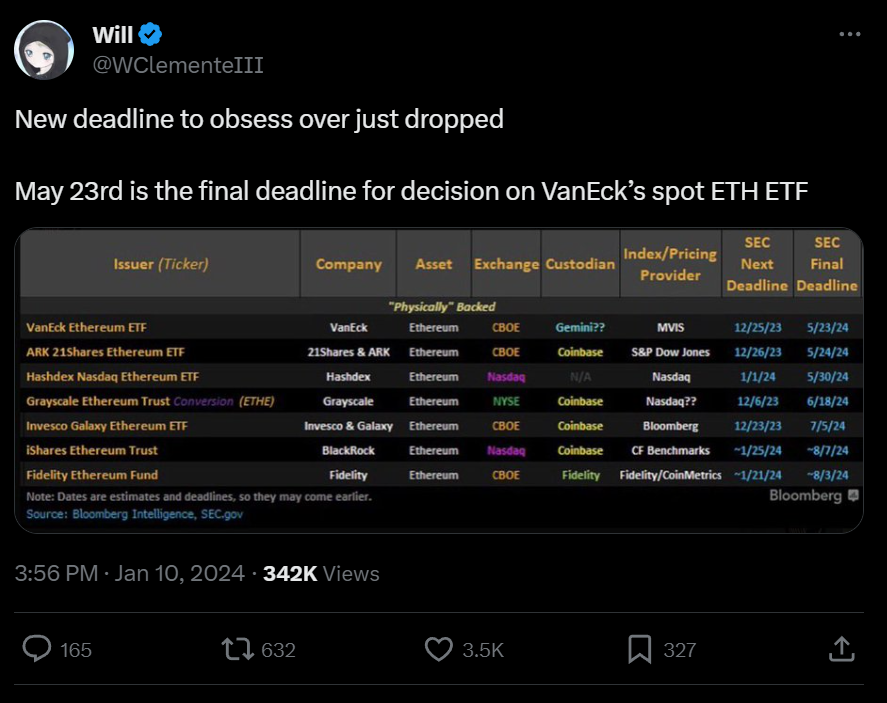

Could an ETH ETF Approval Be the Next Major Development in the Crypto Industry?

After yesterday’s historical spot BTC ETF approval, can you guess what’s cooking in the crypto kitchen? Rumor has it that Ethereum might be getting its own ETF nod in May, and the market is riding the speculation rollercoaster!

The ETF guru, Eric Balchunas from Bloomberg, is giving it a 70% chance of happening. That’s like saying there’s a 70% chance of finding a unicorn at the end of a rainbow! 🌈🦄

ETH ETF Price Speculation

In the last 24 hours, Ethereum’s price did a happy dance, shooting up 8% to $2,671. Talk about crypto optimism! It’s like the market’s shouting, ‘Show me the ETH ETF, baby!’ This follows the SEC giving a nod to eleven Bitcoin ETFs, making it rain in the crypto space.

Did You Expect This ETH Surge? Go Check Out This Trading Competition on Bybit With $2 Million in Prizes

Joe Caselin from BIT crypto exchange spilled the beans, saying, ‘It’s a classic case of ‘buy the rumor, ignore the news, buy the next rumor.’ BlackRock, the big player in town, filed for an ETH ETF in November 2023. While it’s not as certain as getting your morning coffee, the potential is massive. It could be Ethereum’s debutante ball in the ETF world!’

On X speculations are already circulating about the new potential date of an ETH ETF by VanEck on May 23rd, 2024. Yes, you read that right, that’s this year!

But, and there’s always a but, there’s some drama. The current SEC chair, Gary Gensler, is not exactly throwing a crypto party. He thinks every crypto, except Bitcoin, is a financial security. It’s like saying every pizza topping, except cheese, is just a weird choice. 🍕

But hey, there’s hope! Gensler’s predecessor, Jay Clayton, once hinted that if some tokens spread their wings and become super decentralized, they might dodge the financial security label. William Hinman, a former SEC director, even said back in 2018 that Ethereum, with its decentralized vibe, is not a financial security.

Final Words

So, will Ethereum get the golden ticket to the ETF party? We’ll find out soon. Until then, let the rumors roll, and may the crypto odds ever be in your favor!” 🚀💰

Make sure you trade responsibly with risk management and this will be a fun year.

If you enjoy our content, you can support us by signing up for a Bybit Account with our referral link. Don’t forget to claim your bonuses if you buy/sell or trade crypto.

You might also like our recent content about The Best Airdrops of 2023 & Solana

Leveraging Technology for Increased Sales in Modern Retail and Hospitality Businesses

Businesses are increasingly turning to technology to give them an edge over their competitors. They are using it to work more effectively and to improve their turnover.

Below, is an overview of the key tech the retail and hospitality sectors are either currently using extensively or are planning to use to sell more.

Digital signage

The vast majority of companies that have physical outlets now use digital signage. The cost of this technology has plummeted in recent years and the latest screens are cheap to run.

Consumers notice messages and offers delivered via digital signage more than those they see on static paper advertising materials. Because short videos as well as images, gifs and memes can be displayed it is quite easy for retailers to tailor their message to appeal to their customers. Bigger digital signage companies like Mandoe Media include access to vast libraries of images and footage in their packages. The best software includes the ability to use live sales data to immediately determine whether a specific advert is working. If it is not, the shop, hotel or bar owner can tweak the images or videos to make them more impactful or display a new promo.

Digital signage can also be used to improve the ambience and make things easier for clients. It can also be used to evoke feelings, which enhance the customer experience while making it more likely that they will want to buy.

AI-driven unified commerce software

For any business understanding what sells well and what does not is the foundation of boosting sales over the long term. Tapping into the data that is generated by each transaction or business process is the key to gaining that understanding.

In the past, that would have meant manually pulling information together from different sources, including ordering, sales, wastage, and stock control systems. Today, that vitality information can automatically be pulled together using unified commerce software.

Once all of that data is in place, firms can see what sells well, what doesn´t, and how much profit each product or service generates. As well as manage their stock or the items they need to provide a physical service effectively. Thus, ensuring that they always have exactly what customers want available, which is essential for selling more. After all, if something is not available, it cannot be sold. Plus, if a customer cannot get what they want, the chances of them coming back at a later date are slim.

According to recent research conducted by LS Retail, 81 per cent of retailers plan to introduce unified commerce software. They have woken up to the fact that this technology is a fast and efficient way to sell more. The best packages map out when seasonal stock should be purchased, recommend price points and much more.

Internet of Things (IoT)

Retailers are also using IoT to help them to manage their inventory, ensuring that there are fewer out of stocks, which boosts customer satisfaction and leads to more repeat custom. The hospitality industry is also using it to reduce spoilage. The less a restaurant throws away the easier it is for them to keep their prices low enough to tempt more diners through the door.

Augmented Reality (AR)

Augmented Reality is increasingly being used to help customers try on clothing items virtually. Stores no longer need to carry a lot of expensive stock, which keeps overheads down, savings that can be passed on in the form of lower prices. Hotels are also using this technology to allow potential guests to view their rooms and facilities before they book.

Contactless technology

Making it easier for customers to carry out transactions and do things in a way that suits them best, greatly increases sales. For example, using keypad or QR technology hotels can allow guests to arrive and depart at any time of the day or night.

Using AI to personalise the shopping experience

People respond positively to being looked after. The easier it is for them to find what they want at a fair price the more likely it is that they will buy. AI makes it extremely easy for businesses to take what they know about each customer and create a personalised shopping experience for each individual. Sales data, survey responses, and even customer addresses can be combined to work out what types of products a customer will want to buy in the future. When a business owner uses AI, they no longer need to spend time manually crunching the data and reviewing reports.

AI is also incredibly good at helping customers with their questions and issues. Chatbots are becoming increasingly effective.

Why focusing on selling more is the key to success

Selling more makes businesses more robust. They become better able to trade through downturns and take advantage of new opportunities. It also boosts a business’s ability to buy for a low price. Products can be bought for a lower price, which improves the bottom line, while also providing customers with a better service.

Blake Corum selected as the 2023 Allstate AFCA Good Works Team® Captain

NORTHBROOK, Ill., November 28, 2023 – First Team All-American and star running back at the University of Michigan, Blake Corum, adds another prestigious title to his collection as he is named this year’s honorary captain for the 2023 Allstate AFCA Good Works Team®.

“It’s an honor to be the captain for the Allstate AFCA Good Works Team,” Corum said. “My passion for giving back is genuine and driven by purpose. I don’t seek recognition, but it’s heartening to see the impact my efforts have on my community, fans and partners like Allstate.”

Since 2021, Corum’s “Giving Back 2 Give Thanks” turkey drive has become an annual tradition in the Ann Arbor area. Using funds from his name, image and likeness opportunities, he provides turkeys and Thanksgiving essentials to families in underserved communities in Ypsilanti, Michigan. In addition to the turkey drive, Corum actively volunteers at the Community, Leadership, and Revolution Academy, supporting young children in their aspirations through sports nutrition, reading, and writing.

The Allstate AFCA Good Works Team acknowledges college football athletes across divisions for outstanding community service. Since the roster announcement in September, fans have actively voted for their honorary captain based on impactful community efforts on ESPN.com/Allstate.

“Blake is a solid example of compassion and an ardent advocate for community involvement,” said Troy Hawkes, executive vice president and general manager of sales at Allstate. “His unwavering commitment has made a positive impact, and we anticipate it will continue to do so.”

Corum will be recognized at The Home Depot College Football Awards Dec. 8 on ESPN, and at the Allstate Sugar Bowl® on Jan. 1. Learn more about him and the commendable efforts of the 2023 Allstate AFCA Good Works Team at ESPN.com/Allstate.

###

About the Allstate AFCA Good Works Team®

The Allstate AFCA Good Works Team was established in 1992 by the College Football Association, recognizing the extra efforts made by college football players and student support staff off the field. The AFCA became the governing body of the award in 1997 and continues to honor college football players who go the extra mile for those in need. Allstate worked to present the award starting with the 2008 season. The Southeastern Conference (SEC) leads all conferences with 84 selections to the Allstate AFCA Good Works Team since it began in 1992. The SEC is followed by the Atlantic Coast Conference with 55 selections and the Big 12 Conference and Minnesota Intercollegiate Athletic Conference, both with 41 selections. Georgia is in first place with 23 honorees to the Allstate AFCA Good Works Team. The Bulldogs are followed by Kentucky and Bethel (Minn.) with 17 honorees. Super Bowl XLII, XLVI and XLI champion quarterbacks Eli and Peyton Manning were members of the 2002 and 1997 Allstate AFCA Good Works Teams, respectively.

About the AFCA

The AFCA was founded in 1922 and currently has more than 11,000 members around the world ranging from the high school level to the professional ranks. According to its constitution, the AFCA was formed, in part, to “maintain the highest possible standards in football and in the coaching profession” and to “provide a forum for the discussion and study of all matters pertaining to football.”

For more information about the AFCA, visit www.AFCA.com. For news, check out insider.afca.com and subscribe to our weekly email. To get more in-depth articles and videos, please become an AFCA member. Get information about membership and specific member benefits on the AFCA Membership Overview page. To join, please fill out the AFCA Membership Application.

Post Views:411

Beating Broke: Conquering a Credit Card Addiction

Dear Dave,

I think my mother-in-law has a serious credit card problem. She can’t afford stuff, but she shops anyway, chalks up more and more debt, acquires more credit cards, and thinks she’ll pay for it all later somehow. Her ex-husband has bailed her out a few times, but he’s unwilling to help anymore. My wife and I, and my wife’s sister, want to address this issue, but we’re all worried about her reaction, and we don’t know where to start. Do you have any advice?

Randall

Dear Randall,

First, everyone involved should understand they’re likely to receive an angry response from this lady if she’s confronted over her actions. Sometimes people get ticked off when they hear the truth, especially when it’s connected to their own misbehavior. It may even be a good idea for your wife and her sister to get some advice from a

family counselor beforehand. Really, what we’re talking about here is an intervention.

Also, you need to stay out of the discussion. This is something for her daughters to handle. Support your wife and her sister through it all, but if you’re in there asking questions and probing around, you’re liable to come off as the evil son-in-law. And you folks don’t need to add any more problems to the mix.

They need to sit down with her in a quiet setting, one where there are no interruptions, no television and no one else. Start with the fact that they love her and care about her deeply. That’s very important in a situation like this. But they also have to walk through what’s really going on, and let her know they’re tired of watching her destroy herself, and her finances, with her irresponsible behavior.

If she had a drinking problem, you’d want to try to make her see how alcohol was hurting her and the relationships she has with her family. In this case, she basically has a credit card addiction. And it’s wreaking havoc on her financial well-being and people who care about her.

So, show as much love and understanding as possible. But someone needs to say something soon.

— Dave

*

Dave Ramsey is an eight-time national bestselling author, personal finance expert and host of The Ramsey Show. He has appeared on Good Morning America, CBS This Morning, Today, Fox News, CNN, Fox Business and many more. Since 1992, Dave has helped people take control of their money, build wealth and enhance their lives. He also serves as CEO for Ramsey Solutions.

Dave Ramsey

is an eight-time national bestselling author, personal finance expert, and host of “The Ramsey Show.” He

has appeared on “Good Morning America,” “CBS This Morning,” “Today,” Fox News, CNN, Fox Business, and many more. Since 1992, Dave has helped people regain control of their money, build wealth, and enhance their lives. He also serves as CEO of Ramsey Solutions and is the author of numerous books including Baby Steps Millionaires: How Ordinary People Built Extraordinary Wealth–and How You Can Too.

Affiliate Marketing | Make Money Online

Thanks for tuning in to [Wealth Manifesto] – where we empower you to achieve lasting financial success! #WealthBuilding #FinancialSuccess #GetRichSlowly #LongTermInvesting #FinancialFreedomTips

source

Measuring Construction Key Performance Indicators: Analyzing Backlog and Pipeline of Work (Part 2 of 3) in Business Administration

Backlog and the associated pipeline of work is the second group of key performance indicators for a contractor. With construction, understanding the volume of existing contracts, i.e. backlog, aids the management team in setting production goals in the near term. In conjunction with pipeline information, a contractor can quickly ascertain future financial performance. In order to do this, the contractor must create a set of key performance indicators that identify existing dollar value of signed contracts not yet started along with their respective time constraints. Furthermore, the pipeline of potential work is stratified in groups and historical performance guides the management team with what to expect for future work beyond the near term.