tadamichi

Moats and Monopolies

Welcome to Moats and Monopolies! Here we try to share honest, well researched and objective analyses of high quality long only stock picks. This is the first full year update since we started sharing our portfolio here on Seeking Alpha to enhance transparency for readers and followers of our writing as well as allow for others the chance to follow along with our investment journey. Below you can see previous updates to see how our portfolio evolves and performs over time.

| Q2 2023 | In this initial share, we discuss our professional background and reasons for sharing publicly the portfolio. |

| Q3 2023 | In this update, we go into more detail regarding our investment philosophy and the portfolio (as well as our pen name) was changed to Moats and Monopolies. |

Investment Philosophy in 100 Words

We are long only and 99% invested in the stock market (with 1% speculatively invested in Bitcoin). We invest in companies from around the world that can compound their revenues over time – ideally with high margins. We prefer companies with low capital expenditures and low debt levels. We look for companies with defensible moats and love to see companies with sustainable monopolistic parts to their businesses. We have no problem paying for quality and believe that the key isn’t valuation but patience – we expect to beat the market by buying better than average companies and holding for the long term.

Changes

Buys

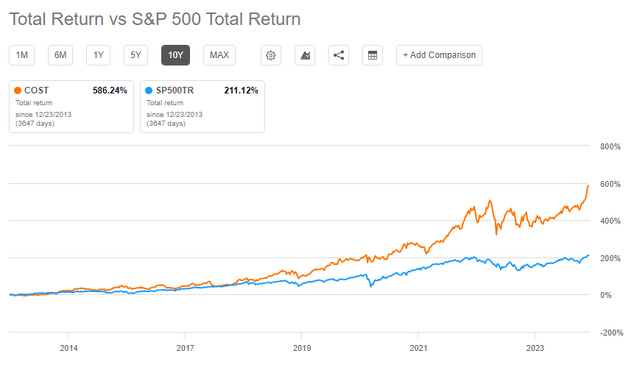

Costco (COST) – So, did we purchase the company at a time with record valuations at all time high prices? Absolutely. Do we regret it? Nope. We have been waiting for a while to purchase this amazing long term winner at a discount and have failed miserably to find that time. Despite all of the number crunching, it always appears expensive and always outperforms the market. For any of you living in caves, Costco is a discount wholesaler and probably the best retailer in the world. The business model is pretty simple – sell a lot of stuff and sell it for a smidge above purchase price, leading to wafer thin margins; however, the genius is that customers need to be paying members to enter stores. This adds a second very high margin, recurring revenue aspect to Costco as well as an inbuilt detraction from one of the themes of the year in the industry – shrink aka theft. If Costco’s customers, who remember are paying for the right to access bulk household goods and groceries at the cheapest possible available prices, are caught stealing, they could well lose their membership. The company builds out a limited number of new warehouses each year and are spreading slowly internationally. Over time, these warehouses earn more and more. As cashflows build up on the balance sheet, Costco pays intermittent ‘special dividends’ to remove excess cash and return it directly to shareholders. The company’s share price has been on a rip this year, and it wouldn’t be a surprise to see comments stating as much below the line; however, we intend to hold it forever and are confident that the orange line below will continue to deliver that delicious Alpha that we are all on this platform to find.

The Quality of Costco (Seeking Alpha)

The Beauty Health Company (SKIN) – It is entirely possible that you have never heard of this company, whether living in a cave or not, and are now wondering how to find out more about it. Feel free to consider an overview of their business model here and a brilliantly timed ‘buy rating’ here. In a nutshell, it is a B2B company that delivers machines that provide high end facials to mostly beauty salons and spas. They have a great core business whereby they upskill and train beauticians to use their devices and then once installed, sell proprietary consumables that are required for each treatment as well as celebrity endorsed customisable ‘boosters’ to further enhance the experience. That is a great razor and blade business model and one that we have compared to Intuitive Surgical (ISRG) in the past. So why has their share price cratered this year? Well, put simply they have been terribly mismanaged. On one hand, their products are now being sold in high end retail outlets such as Harrods of London and LVMH (OTCPK:LVMUY) owned Sephora. On the other, there has been a near constant change within the C-Suite, the previous management teams have been buying back shares with the IPO money (the company is still not profitable) as well as constantly discussing new verticals and growth areas rather than focus on their core product. The company then lost around 2/3rds of its value in a single day when the CEO failed to turn up to earnings, the company declared that he was leaving and that they had had to replace many faulty new machines to uphold their reputation with clients. So why is the company on our buy list? Simply, the market completely threw the baby out with the bathwater and offered a mouth watering price that has already doubled in the past month or so. It is easily our most speculative investment but it could be a multibagger over time if they can get a decent leader in.

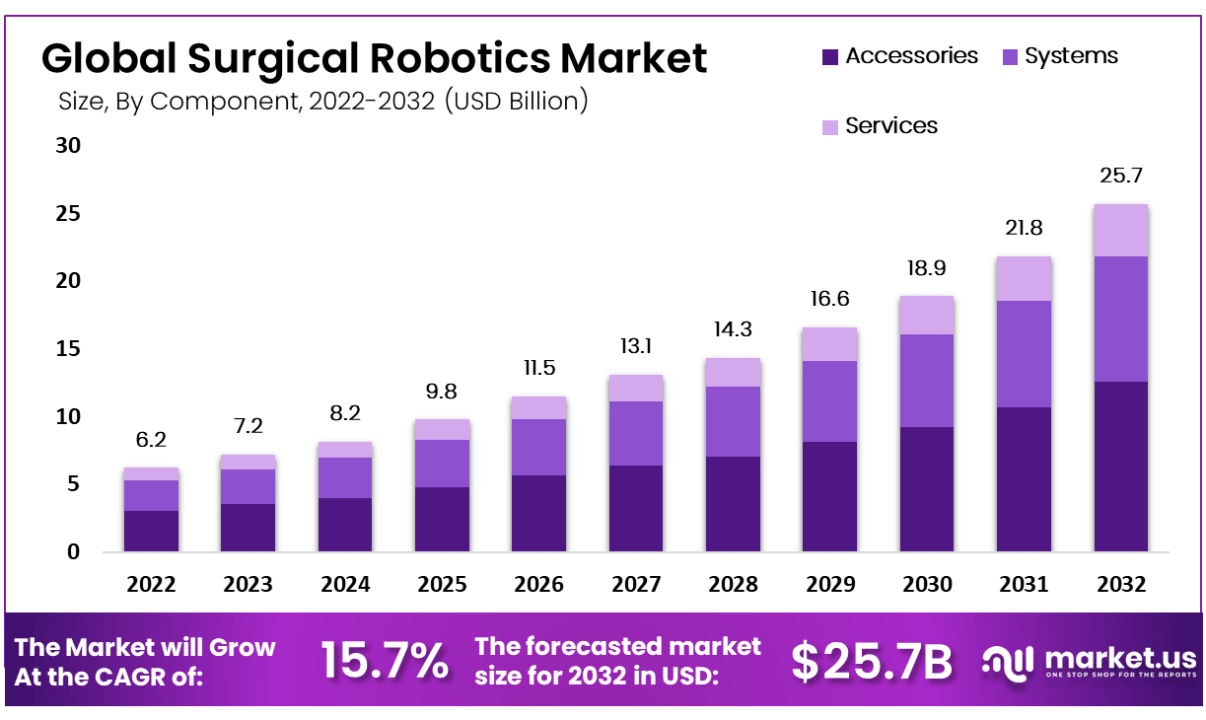

Intuitive Surgical (ISRG) – An incredibly expensive but market dominating surgical robot provider. It has a razor and blade model in which it installs its equipment in hospitals and then sells the consumable instruments that are needed to carry out surgeries. The company has worked closely with medical teams to ensure that they are upskilled to work alongside its devices. This network effect then carries over to hospitals that will expect new doctors and surgeons to be able to use their capital expensive machines. It is a network effect that should resist the entry of competitors in the next few years when/if Johnson and Johnson (JNJ) and/or Medtronic (MDT) get their devices over the upcoming regulatory hurdles required to sell their devices. However, there is a chance that the share price or the current eyewatering PE of around 60 would contract should that happen. This is definitely a long term play, but as the market for surgical robots could quadruple from here out a decade, even if Intuitive’s market share were to decrease, there are still plenty of future cashflows available for new investors to benefit from. Further, investors often completely overweight the impact of competition on our decision making. Take Netflix (NFLX), which lost a lot of its market cap partially down to the perceived threat of Disney (DIS) and Warner Brothers (WBD) and their respective streaming options. If these media goliaths with their backcatalogues and enviable IP cannot make a serious dent in how we watch TV, it is not a stretch to argue that in the far more important world of life altering surgery, Intuitive can protect its moat against even the strongest of competitors.

Global Surgical Robots Market Forecast (market.uk)

Sells

Enphase (ENPH) – We did something quite unusual with Enphase. We bought and sold very quickly, within a couple of months. Enphase is a market leader in the residential solar space that has been punished by increased interest rates and decreased subsidies across various markets, both of which have made installation less lucrative for home owners. We saw a price mismatch and bought in; however, there is little recurring revenue and the more we researched the more we felt that the product was becoming increasingly commoditized. With that, the recent bounce after the company announced layoffs brought about an early exit opportunity wherein we walked away with a small profit. It has been chalked up to learning experience and we move on. Enphase is probably still a good investment long term at these price levels; however, we could not accurately forecast future cash flows and so moved funds towards other opportunities.

MSCI India (INDA) & MSCI World Health (FHLC) – As the confidence in our investing strategy has increased, there are some old remnants of a more diversified past portfolio that needed to be cleared out. The original theses for these ETFs had been quite straightforward: India is an emerging market with a huge potential for innovation and entrepreneurship as well as the world’s largest population and democracy. Healthcare is a safe industry to invest in but a tricky one from which to individually stock pick. As we move forward, having a smaller number of high quality companies and being more focused will support our endeavors of beating the market over the longer term. Much of these funds were consolidated into the Nasdaq 100 (QQQ) ETF that we will continue to own for the long term.

Rightmove PLC (OTCPK:RTMVY) – Rightmove is a great little company. It’s an estate agent listing portal that has some of the best margins of any company in any industry in the world. If you are looking for a play on the UK housing market or if you are a UK economy bull, consider reading this. However, we are increasingly concerned that the damage done to the country post Brexit may well mean that the opportunity cost from holding this company in the portfolio could affect our returns as it is almost exclusively reliant on the UK market for its revenues.

The Moats and Monopolies Portfolio

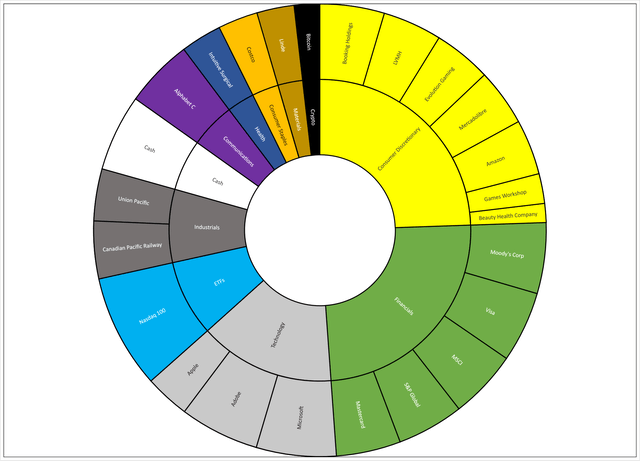

The Moats and Monopolies Portfolio (Author’s Work)